As the calendar turns to March, the crypto market is on the brink of significant change. Here we provide carefully-curated analysis of eight impending events with the potential to shake up market trends, highlighting the interconnectedness of regulatory actions, economic indicators, technological advances, and legal proceedings. I'm doing it.

Each event is a thread in the larger tapestry of the cryptocurrency ecosystem, poised to weave together stability or unravel instability.

1. Federal Reserve Bank Term Funding Program

The Federal Reserve's Bank Term Funding Program (BTFP) will cease new lending on March 11th. Established under Section 13(3) of the Federal Reserve Act, the BTFP was designed to provide liquidity for eligible institutions during the financial crisis.

This conclusion signals a transition to normalcy after economic stress, with financial institutions continuing to access liquidity through the discount window. It will also spill over into the banking sector, indirectly impacting the liquidity and stability of the crypto market.

Adjusting the interest rate on new loans to no lower than the interest rate on reserve balances emphasizes strategic alignment. This allows the program to effectively support its goals until its expiration date.

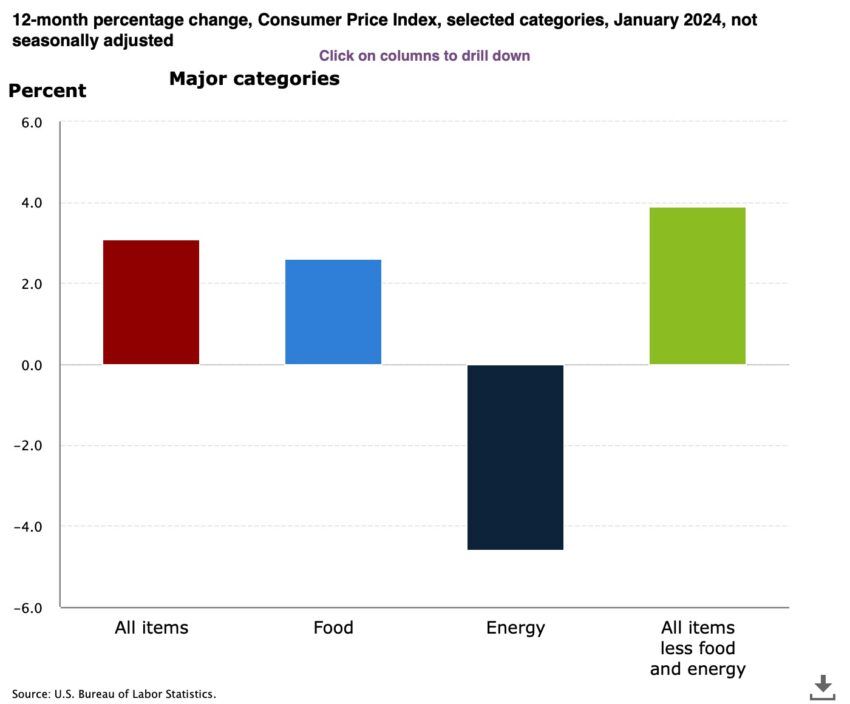

2. Release of US February CPI data

February consumer price index (CPI) data, to be released on March 12, will be a key indicator of inflation. This data is critical to economic policy and investment strategy because it influences the Federal Reserve's interest rate decisions.

Cryptocurrency markets are often sensitive to inflation signals. These may influence the Federal Reserve's monetary policy decisions and influence investor sentiment towards risk assets, including cryptocurrencies.

For example, high inflation rates indicate economic uncertainty and may lead to a shift in investments to non-traditional assets such as cryptocurrencies.

3. Dencun upgrade for Ethereum

The Cancun-Deneb Upgrade (“Dencun”) of the Ethereum network, scheduled for March 13th, is focused on performance. He aims to enhance scalability, efficiency, and security through various Ethereum Improvement Proposals (EIPs), including his EIP-4844 for Protodunk Sharding.

This upgrade is critical to Ethereum's roadmap towards massive scalability. This also represents a leap forward in blockchain technology, making Ethereum more accessible and increasing its usefulness across sectors such as DeFi.

| chain | DEX swap gas fee cost | Expected DEX swap cost after EIP-4844 |

| ethereum mainnet | $6.38 | $6.38 |

| stark net | $1.16 | $0.12 |

| optimism | $0.38 | $0.04 |

| Arbitrum One | $0.26 | $0.03 |

| polygonzkEVM | $0.24 | $0.02 |

| zkSync light | $0.21 | $0.02 |

The focus on scalability and efficiency with innovations like Layer 2 rollups and EIP-4844's temporary data blobs could have a significant impact on Ethereum's performance and user adoption.

Read more: Ethereum (ETH) Price Prediction 2024 / 2025 / 2030

4. FTX's first meeting of creditors

FTX's first meeting of creditors to be held on March 15 is aimed at establishing a liquidation committee as part of the formal liquidation process. This meeting is critical for stakeholders to understand the progress of the clearing, the claims process, and the impact on the crypto market.

Information shared during the creation and meeting of the Clearing Board could provide insight into the impact of FTX's failure and future regulatory oversight.

5. NVIDIA's GPU Technology Conference

NVIDIA's GPU Technology Conference on March 17th will announce advances in GPU technology, including the H200 and B100 models. These innovations, which leverage TSMC's advanced nanometer processes, have a significant impact on computational tasks such as crypto mining and proof-of-work (PoW)-dependent crypto valuation.

Enhancing GPU efficiency and capacity will impact the economics of mining and potentially impact supply and operating costs within the cryptocurrency market.

6. Fed interest rate decisions

The Fed's stance on interest rates, highlighted by Chairman Jerome Powell's remarks, is a barometer for determining the direction of economic policy. Interest rate decisions affect borrowing costs and influence investor sentiment towards risk assets, including cryptocurrencies.

The Fed's approach to managing inflation while ensuring economic growth and job security is critical to market confidence.

“If the economy progresses broadly as expected, it will likely be appropriate to begin tapering policy restraints at some point this year. However, the economic outlook remains uncertain, and the outlook remains uncertain, as we continue to move towards the 2% inflation target. Continued progress is not guaranteed,” Powell said.

The financial world will be closely monitoring changes in interest rates ahead of the Federal Reserve Board (FOMC) meeting on March 20th. Such decisions directly impact the investment environment and impact the attractiveness of cryptocurrencies as alternative investments in the face of rising or falling traditional asset yields.

7. SEC fraud trial against Do Kwon

The delay in legal proceedings against Do Kwon due to extradition challenges highlights the regulatory scrutiny facing the crypto sector. Trials such as Kwon's securities fraud charges reflect the legal complexity and the potential for regulatory outcomes to impact market perceptions of crypto entities.

The start of Kwon's trial on March 25 is a reminder of the regulatory risks and legal uncertainty in the crypto industry.

8. Sentencing of Sam Bankman Freed:

The March 28 sentencing of Sam Bankman Freed, who was found guilty of defrauding FTX customers, marks a key moment in the enforcement of crypto regulations. This highlights the consequences of regulatory non-compliance and governance failures and may shape future regulatory and market trends.

The outcome could impact future regulatory actions, investor confidence, and operating standards for virtual currency exchanges and platforms.

Read more: 10 Best Cryptocurrency Exchanges and Apps for Beginners in 2024

Together, these events form a mosaic of factors that can move the market. Each has important implications, influencing investor sentiment, the regulatory landscape, and the technological evolution of the cryptocurrency market.

Disclaimer

All the information contained on our website is published in good faith and for general information purpose only. Any action you take upon the information you find on our website, is strictly at your own risk.