I'm often accused of saying it's always a good time to buy. People read my newsletter and say, “You look so rosy,'' or “You make it look like it's a good time to buy, and then you turn around and tell sellers that now is the time to sell.'' I tell them it’s a good time.” Well… there is truth to all of this and here’s why… at least this is my approach. Regardless of which side of the equation (buying or selling) everyone's goals are different. Generally speaking, in life, it's better to just get on with it. I learned the following: I take action Most successful. They may fail sometimes, but their victories outweigh their failures and they are winners. For some, it may be too general or too vague. So let's break it down.

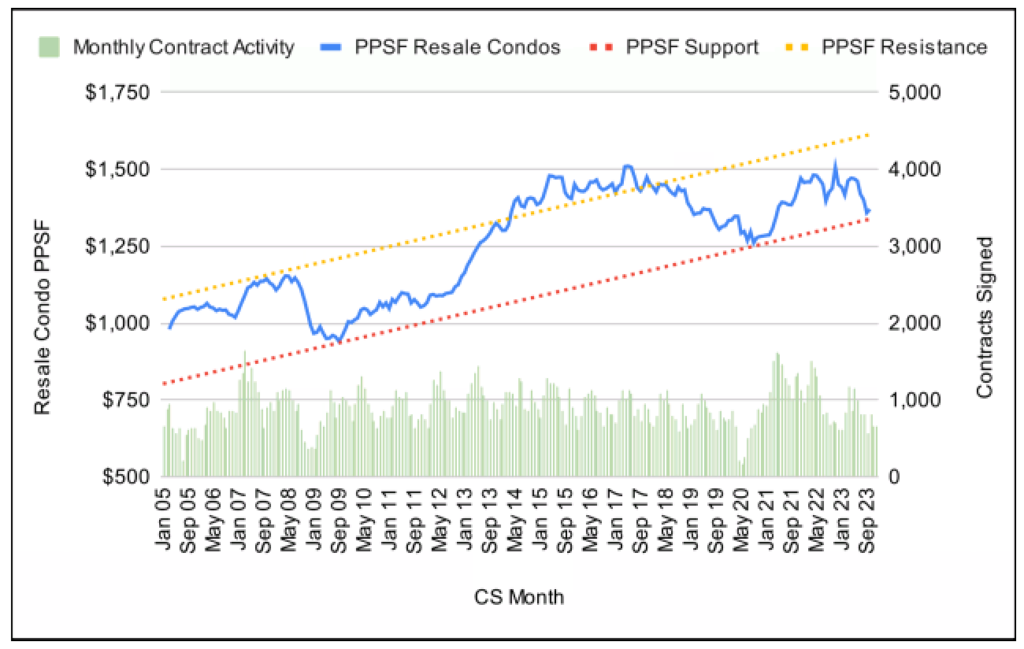

So let's take buy beginning. Too many buyers try to “time” the market. This is a fool's errand because the market changes like the weather. As we move from winter to summer, the weather gets colder, hotter and back again, depending on the day. There may be rain, sleet, etc…it's hard to predict. However, we generally know that the closer we get to summer, the warmer it gets. The market is similar, with fluctuations from day to day and seasonal market cycles, but the trend is generally upward over time. That is, if you are in it for a reasonable period of time and experience “''time at market” instead of “timing” the market, you could end up with a much better outcome. Over the years, you can build up the equity in your property and avoid wasting money on rent. We must be mindful of this, given that these buyers are seeking to create a “home” with unique attributes and rewards that cannot be quantified. Buying real estate as an investor may assume completely different considerations, goals, and time horizons, and to a lesser extent my assumptions apply. However, rents are very high in Manhattan (highest in the nation) and my premise still holds true.

Click on each graph to expand it. Provided by: UrbanDigs

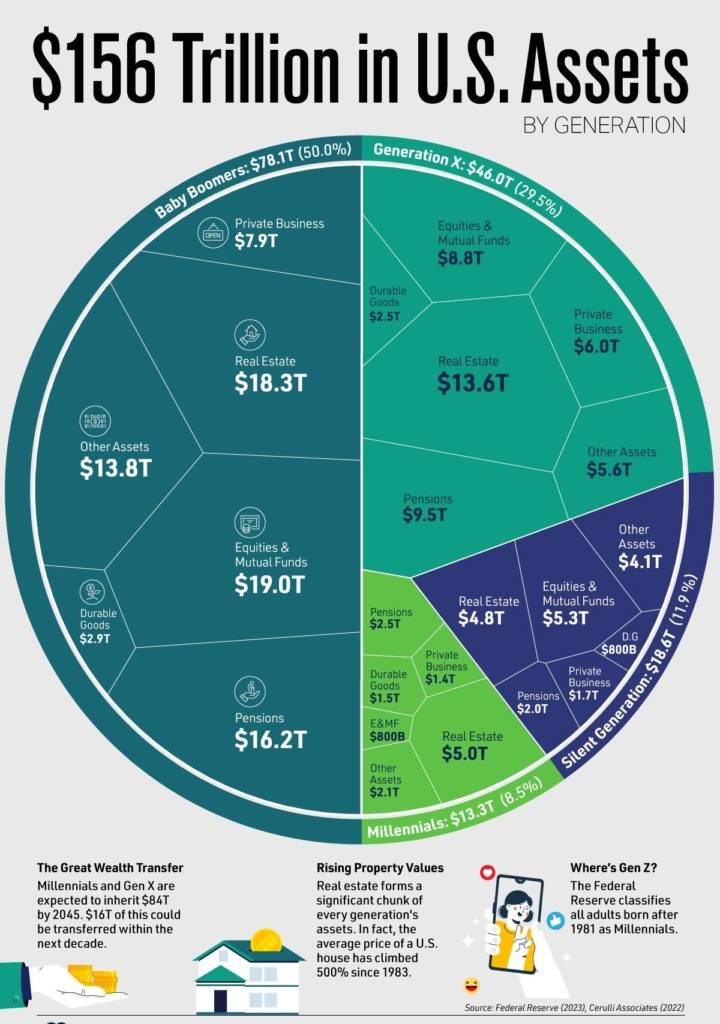

Now let's put this in further context. baby boomer They have amassed overwhelming wealth, much of which remains in the form of cash. Let me explain how much this is. Many estimates indicate that $5-6 trillion has been injected into the economy over the past three years. This is something we have never seen before. However, similar estimates say that over the next 20 years, between $50 trillion and $70 trillion (about 10 times more) will be transferred from baby boomers to younger generations (this will take place in a variety of ways). , half of which will be real estate and cash)).Much of this wealth will be used to purchase current premier asset class…real estate. Over the next 15 to 20 years, this cash, coupled with a desire to buy real estate, will be used to buy second and third homes, as well as homes and investment properties for children and grandchildren. Now consider how that level of demand will affect prices (and therefore values) in the coming decades, especially if supply shortages remain an issue.

Provided by: Federal Reserve System

We are still reeling from the effects of the 2008 housing crisis. Since then, the level of new construction over the past decade and a half has fallen significantly compared to the 90s and his early 2000s. More recently, rising interest rates and government regulations have put even more pressure on this economic slowdown. Thankfully, there is light at the end of the interest rate tunnel. Another factor is new buyer They (mostly Millennials) are entering the market year after year. This measurable increase in demand into the future means there may never be enough inventory to meet your needs.

Imagine if you bought a good property now (sooner or later). The tide (in this case the wave of wealth transfer) lifts all boats. This is exactly the basis of my premise. largely It's always, “generally”, a good time to buy. All you need to do is find the right property for your unique situation and time period.

Manhattan currently appears to be bouncing along the bottom of the current cycle. This cycle sees trading volumes gradually decline as a result of demand, as a result of inventory shortages, and as a result of the financial crisis.double level of interest. Well, all reasonable signs are that interest rates are currently stable and will eventually fall. So if you are still so interested in “timing” the market, please consider this special moment, especially since there is nothing you can do about it in the long run. Prices have fallen by about 8-10% over the past year, and prices reflect a period somewhere between 2018 and 2019. Given all market fundamentals, particularly low inventory levels* and impending interest rate declines, this level of regression is unlikely to be repeated anytime soon. So… think about where we are at the moment we are at the beginning of 2024 and compare it to where we will be in 2030, 2035, 40, 45….

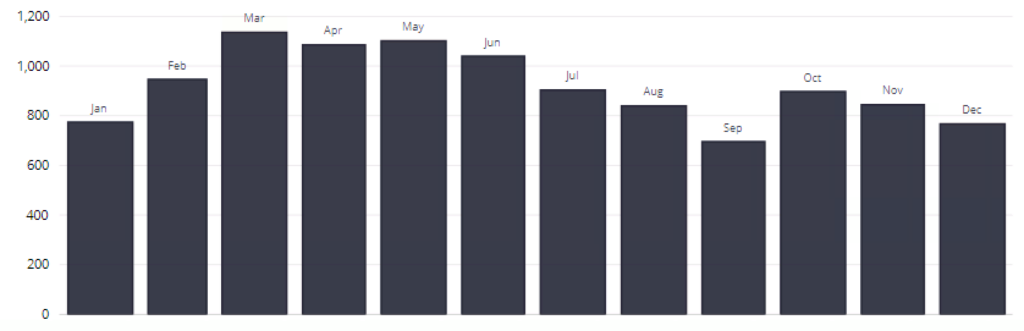

now sale This is a slightly different proposition and can usually be worked out by taking advantage of conventional market cycles. That being said, each seller has a special agenda as to why exactly they are selling. What that is will determine how aggressively you carry out your plan. Here are some reasons to sell: Are you upgrading? Downsizing? Did you get a new job in another region or city? Need money?… The scenarios are endless. Historically, there are times of the year when it is easier to sell than at other times, such as mid-to-late February through May, the short market that emerges in the fall, and after Labor Day through the first or second week of November. Conversely, the period from late summer and Thanksgiving to late January is considered the least productive period.

Best time to list

Provided by: UrbanDigs

Both scenarios are typically determined by the number of buyers in the market. Armed with this information, you can be a little more selective about when you create your list. However, the point is the same. In life, it's better to just get on with it. Some sellers weigh every penny bitterly, thinking they would be better served and get better results if they just accepted the solid results and moved on to the next chapter. Some sellers put their lives on hold completely while pursuing diminishing returns. If they make it through, the immense rewards of living their lives while attacking their own life plans are exactly what the doctor ordered. When selling, you need to take into account the market conditions given at that moment. Of course, waiting until a few months or even next year might be just fine, but if you go beyond that, you risk damaging your emotional bottom line. You have to make the most of the given market conditions, list at the right price, and get it done.

In either scenario, action And the words that best describe it are, “…there's never been a better time than now.” Yes, I am guilty as charged. But again, as I said at the beginning of this monologue, this is a rough story. Please contact me so we can have a live conversation about the details of your situation.

I always say: 1) Anyone interested in buying or selling should roll up their sleeves to determine if it's the right time to sell or if there's a home/investment property that's right for them. is. and 2) Who represents you matters…The best investment is often with the broker of your choice.Find someone who has experience and thinks you can do it. trust.