Bitcoin and Ethereum led the cryptocurrencies in liquidations as more than 54,000 traders wiped out their leveraged positions and the total market capitalization approached $2.1 trillion.

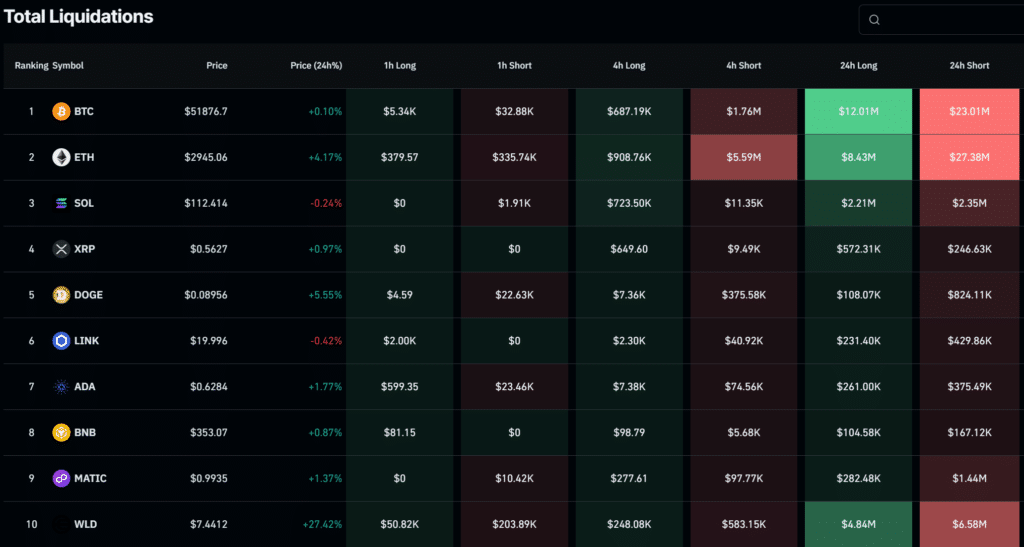

CoinGlass reported that over $145 million was liquidated from the crypto market across exchanges within 24 hours. $91 million of these trades were registered as short positions, as most traders expected the price to fall.

However, the cryptocurrency's market cap rose 1.2% per CoinGecko, and bets on the downside were liquidated. His $4 million Bitcoin (BTC) position in the USDT pair became the single largest liquidation order. The transaction took place on Binance, the largest cryptocurrency exchange.

Traders also lost at least $70 million combined in BTC and Ethereum (ETH) on long and short punts.

Bitcoin, Ethereum rise

BTC and ETH, the top cryptocurrencies by market capitalization, have been trending upward in price over the past week. The token has appreciated by 3% and 11% in the past seven days due to bullish sentiment in the market.

The U.S. Securities and Exchange Commission's (SEC) approval of a Bitcoin ETF on January 10th makes BTC the 10th largest asset in the world, with a price of $51,800 and a market capitalization of over $1 trillion. This appears to be the main driver of Bitcoin's rise. Expectations are also high for the Bitcoin halving scheduled for April.

Some believe that the halving, which cuts the reward for new blocks in half, and the spot Bitcoin ETF's BTC acquisition will cause a supply shortage while demand increases. The leading hypothesis suggests that this will cause a parabolic rise in the cryptocurrency's largest asset.

Ethereum's current momentum revolves around a technology upgrade called Dencun. Developers say this change extends data availability for Layer 2 rollups through the BLOB feature. This allows L2 to add more data to each block, reducing transaction costs and increasing scalability.

Dencun is expected to ship to Ethereum mainnet around mid-March after successful testing on three testnets: Goerli, Sepolia, and Holesky.