A Cook County judge put the question on the March primary ballot regarding real estate transfer tax, a bill that would fundamentally change the way real estate transfers are taxed in the city.

According to the text of the referendumVoters will decide whether the city should move from the current flat tax model on real estate transfers to a graduated tax that affects all transactions over $1 million.

The ballot question was heavily criticized by opponents, who said the question was intended to trick voters into voting “yes,” while others argued that the measure would have a chilling effect on real estate sales in the city.

Supporters said the ordinance would reduce transfer taxes on about 94% of properties in the city.

A statement from the Chicago Coalition for Justice harshly criticized the judge's decision.

“Today’s ruling is disappointing, but not surprising. “He has shown time and time again that he is willing to use the courts,” it said in a statement.

The statement goes on to say that “a small number of wealthy real estate interests would rather spend thousands of dollars in legal fees to maintain a brutally unjust status quo than pay their fair share of taxes.” “I'm furious,” he added.

Mayor Brandon Johnson's office released a statement regarding the matter Friday night.

“'Bring Chicago Home' remains on the ballot,” Johnson said. “While we are disappointed in the court's decision, we will consider all legal options available to us. “We strongly believe that the vote is legally sound and that the final arbiter should be the voters of the City of Chicago.” said the office.

The Chicago Association of Building Owners and Managers praised the ruling, calling the measure a “backdoor property tax” on Chicagoans.

BOMA Executive Director Farzin Paran said: “We are pleased with the judge's decision, which emphasizes the need to present policy issues to the public in a fair, detailed and transparent manner.”

The Chicago Southland Black Chamber of Commerce also supported the decision, saying the measure would harm the local real estate market.

“This victory was something we anticipated and expected, as there were several issues with the ballot question, including the log-rolling issue. Also, the proposed ordinance was in conflict with the business environment for obvious reasons. We believed that this would have a negative impact on both rental markets,” said Board Chairman Dr. Cornell Darden Jr. said:

The Chicago Board of Elections confirmed that the decision has not yet been appealed by the Chicago Board of Elections, as the circuit court has not yet issued a written order based on the findings.

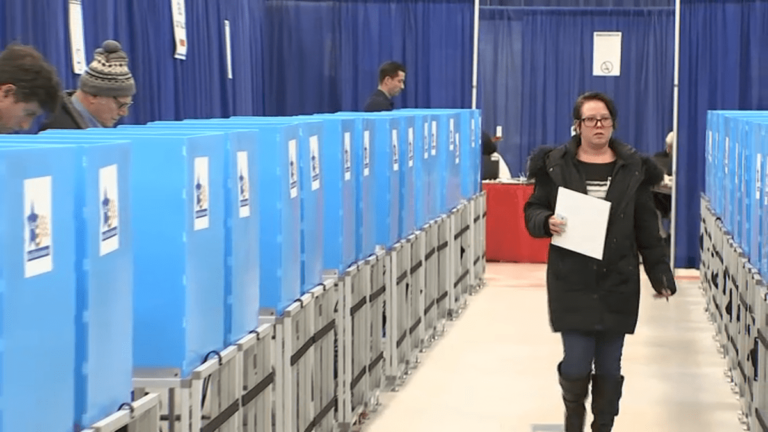

Early voting and mail-in voting will continue until the commission is told otherwise, according to Max Biver of the Chicago Board of Elections.

Supporters of the measure expect the decision to be appealed. Learn more about the proposed real estate transfer tax.