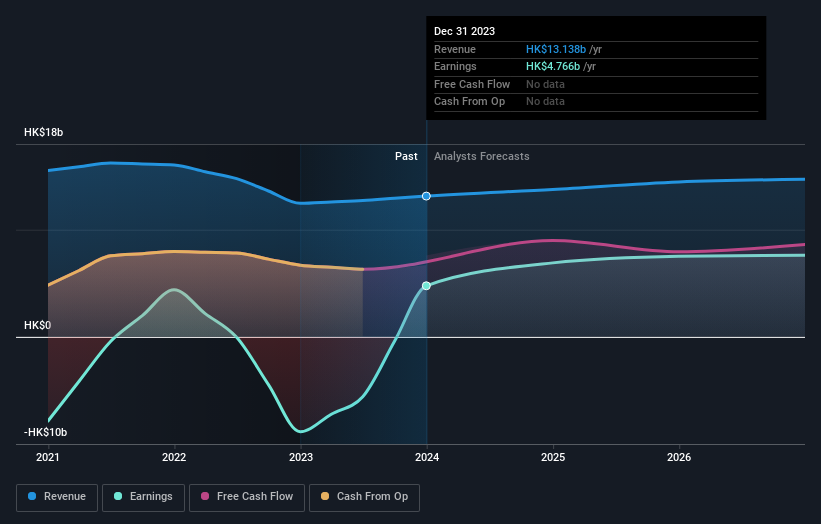

As you may know, Wharf Real Estate Investment Company Limited (HKG:1997) published its latest annual report last week, and things weren't looking too good for shareholders. Wharf Real Estate Investment missed out on profits this time, with revenue of HK$13 billion falling 2.1% below analysts' expectations. Statutory earnings per share (EPS) of HK$1.57 was also 19% lower than expected. Earnings earnings are an important time for investors as they can track a company's performance, see what analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. Our readers will be pleased to know that we have aggregated the latest statutory forecasts to see if the analysts have changed their mind on Wharf Real Estate investment following the latest results.

Check out our latest analysis for Wharf Real Estate Investments.

Following the latest results, Wharf Real Estate Investment's 15 analysts forecast 2024 revenue of HK$13.8b. This represents a 4.7% improvement in revenue compared to the previous 12 months. Earnings per share are expected to rise 44% to HK$2.27. Ahead of the report, analysts had modeled sales of HK$14.2 billion and earnings per share (EPS) of HK$2.33 in 2024. It's clear that pessimism has reared its ugly head after the latest financial results, leading to a slump in stock prices. Slight decline in earnings and earnings per share forecasts.

Analysts said there was no major change to their price target of HK$34.59, suggesting that the downgrade is not expected to have a long-term impact on Wharf Real Estate Investment's valuation. The consensus price target is just the average of the individual analyst targets, so it's useful to see how wide the range of underlying forecasts is. The most optimistic Wharf Real Estate Investment analyst has a target price of HK$48.60 per share, while the most pessimistic has a price target of HK$28.50. Analysts certainly have differing views on this business, but the spread of estimates is not wide enough to suggest that Wharf Real Estate Investments shareholders could be waiting for extreme results. .

You can also look at the bigger picture, including how these forecasts compare to past performance and whether forecasts are more or less bullish compared to other companies in its industry. One thing that stands out about these estimates is that Wharf Real Estate Investments is projected to grow faster than ever before, with revenues expected to grow at an annualized rate of 4.7% until the end of 2024. is. If achieved, this would be a much better result than the 5.3% annual decline over the past five years. In contrast, our data shows that other companies in a similar industry (covered by analysts) are forecast to see their revenue grow at 6.7% per year. Wharf Real Estate Investments' earnings are expected to improve, but analysts remain bearish on the business, expecting it to grow slower than the industry as a whole.

conclusion

Most importantly, the analysts have revised down their earnings per share estimates, indicating a clear drop in sentiment following the results. Unfortunately, they've also revised down their revenue estimates, and our data shows it underperforming compared to the broader industry. Still, he cares more about earnings per share for the intrinsic value of the business. The consensus price target remains unchanged at HK$34.59, and the latest forecast is not significant enough to impact the target price.

That said, the long-term trajectory of the company's earnings is far more important than next year. At Simply Wall St, we have all the analyst forecasts for Wharf Real Estate investing up to 2026, available for free on our platform here.

I don't really want it to rain on the parade, but it did rain. 2 Warning Signs for Wharf Real Estate Investing What you need to be careful about.

Valuation is complex, but we help make it simple.

Please check it out Wharf real estate investment Could be overvalued or undervalued, check out our comprehensive analysis. Fair value estimates, risks and caveats, dividends, insider trading, and financial health.

See free analysis

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts using only unbiased methodologies, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.