- Institutional investors bring capital and seriousness to the crypto conference circuit.

- The advent of Bitcoin ETFs has increased the demand for crypto conferences aimed at professional asset managers.

- Prepare for matching between asset management companies and “allocators”.

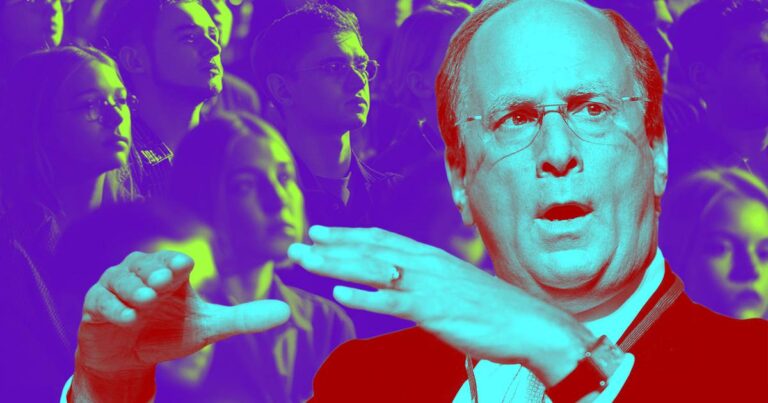

In February, Robert Michnick, BlackRock's global head of cryptocurrencies, took the stage at investment giant BlackRock's first Digital Asset Summit in New York.

There were no fluorescent Lamborghinis to be seen, and there were no lavish yacht parties hosted by Mitchnik and BlackRock CEO Larry Fink.

Without the glamor, it was all about the unencrypted stuff. But what existed at BlackRock's mega-corporate headquarters in Manhattan was extremely important. It was an audience representing great wealth.

Coincidentally, they are now showing up at conferences like this one with their eyes on Bitcoin and its cousins.

Stay ahead with our weekly newsletter

Cryptocurrency conferences are changing. With the advent of Bitcoin ETFs and interest from hedge fund giants like Cliff Anes, crypto players are finding space for a demographic they never expected to make a living from: Wall Street. will need to be secured.

Market trend

At BlackRock's simple event, attendees were eager to consider portfolio allocation, Bitcoin returns, and risk-reward ratios.

Speakers including Dan Morehead, founder of Pantera Capital, and Brett Tejpaul, head of institutional sales, trading and services at Coinbase, shared their thoughts on market dynamics.

There's little doubt that the next time crypto investors flock to Miami and other parts of the world, there will be a giddy feeling, but investment professionals are adding a more serious and sober atmosphere to the conference venue. ing.

Join our community for the latest stories and updates

Anatoly Kratilov, CEO of cryptocurrency hedge fund Nickel Digital Asset Management and former executive director of Goldman Sachs and JPMorgan Chase, said, “The reality is that institutional investors I'm definitely going to avoid party conferences because they don't exist and it's almost all retail investors.” .

“If anything, we want to remove unnecessary fanfare from the industry,” he says. “Instead, let's talk about portfolio construction, risk limiting, and proper allocation within a larger portfolio. That's what I'm interested in.”

Crypto events play a very important role in this space, in part because an unusually large number of participants are working remotely.

Large gatherings provide valuable opportunities to network and speak directly to people, and often attract tens of thousands of attendees. As a result, the conference becomes more than just a gathering, it also becomes a barometer for gauging the mood of the market.

Last year was a mixed one for conference goers, as the bear market took a toll on corporate balance sheets and caused a decline in event spending across a wide swath of the industry.

Mass market appeal

Bitcoin Miami's participants have halved to about 15,000, CoinDesk reported. Meanwhile, the number of participants at NFT.NYC, the New York-centric non-fungible token bonanza, fell by almost two-thirds to 6,000.

The atmosphere has changed as the market has soared. The biggest difference may be how the crypto community has accepted regulation as a necessary price to appeal to the mass market.

Regulators in the UK and European Union have adopted regulatory rulebooks to clarify what crypto companies should and shouldn't do.

And ironically, it was the industry scourge that helped usher in the current boom by approving spot Bitcoin ETFs for issuers such as BlackRock, Fidelity and nine others in January. It was a committee. Ethereum ETFs may be next.

Sponsorship budgets for events and the companies that fund them are now recovering as well.

“In 2023, people were being very cautious, but we're seeing more companies wanting to move out there and promote themselves louder.”

— Emma Joyce, Global Blockchain Business Council

Cal Evans, managing associate at cryptocurrency law and compliance consultancy Gresham International, said his company increased its marketing budget by 25% in 2024 compared to the previous year. Funds will be used for both event sponsorship and digital advertising.

Emma Joyce, head of financial services at the Global Blockchain Business Council, a Europe-focused industry group, said the organization held 132 conferences, roundtables, webinars and dinners in 2023. Stated. This year, that number is expected to increase by about 10%.

“In 2023, people were being very cautious, but we're seeing more companies wanting to get out there and promote themselves louder,” she said. “Companies are still acting smart, but there is certainly room for spending across the industry.”

Simon Barnby, chief marketing officer at Archax, a digital asset firm backed by fund management giant Abdon, said his firm would increase its sponsorship budget by up to a third this year.

That's partly because our products are in sales mode and partly because market conditions have improved. Those things make us feel comfortable spending a little more on events. .”

He added that even in November, people were jockeying for seats at Token 2049's flagship Singapore conference amid mounting hype over the expected SEC approval of a Bitcoin ETF.

come together

But the recovery has coincided with a growing appetite for more robust gatherings targeting institutional investors like BlackRock, as Wall Street's influence grows ever larger in the industry.

Earlier this month, Joyce moderated a blockchain panel at the European Parliament with speakers from the Bank of England, JPMorgan Chase and Deutsche Börse.

“Determining the future of our industry requires businesses, policy makers and regulators all to come together, and a great conference can do that,” Joyce said.

“I'm glad that BlackRock has launched its own summit. We wouldn't have done that last cycle, but this is a great sign.”

— Anatoly Kratilov, Nickel Digital Asset Management

Meanwhile, Kratilov cited TradeTech's DigiAssets conference for asset managers and hedge funds as important meetings for him, and iConnections' Global Alts conference in Miami, which matches asset managers with allocators.

“If I travel for two days, I want to have pre-agreed meetings with people who actually want to discuss the same things as me,” he said. “That’s what’s most valuable.”

“I’m glad that BlackRock has launched their own summit. They wouldn’t have done that in the last cycle, but this is a great sign. You’re in a good position to have a high-level conversation.”

alarm bell

Archax's Barnby agrees that the biggest, flashiest conferences have limited value for institutional investors. It may even come into conflict with the financial company's compliance department.

“Many of these companies are highly regulated, so you have to be very careful about what you do and where you go,” he says.

“They don't want to be seen as engaging in something frivolous, whereas if they're a little more focused and serious, it's easy to avoid compliance,” he continued.

“Sure, big events are a lot of fun. But they're sounding the alarm on regulated institutions.”

alex daniel I am a writer contributing to DL News.