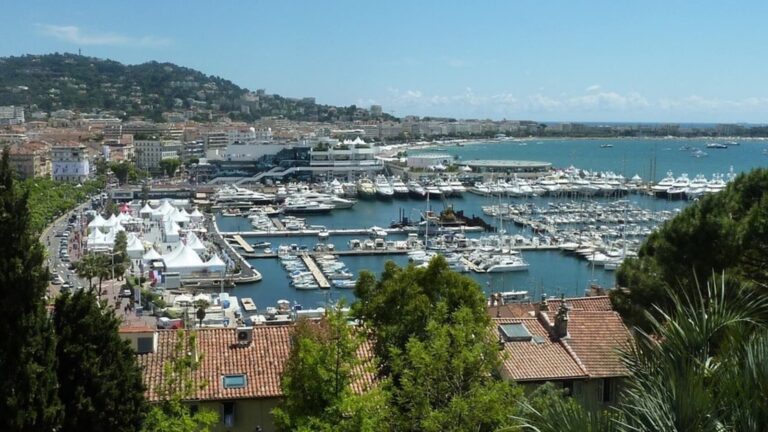

(Bloomberg) — As the real estate industry's biggest names gather in Cannes for Europe's biggest annual real estate event, there are a growing number of notable absentees.

The end of the easy money era has dealt a blow to real estate investing, upending a business model that for years relied on cheap and plentiful debt. Today, many executives who were highly successful during the boom are leaving when the market hits a recession.

Also read: Could India's real estate market face a crisis like China's Evergrande?

The management turmoil comes amid a toxic cocktail for some of Europe's biggest landlords, which are grappling with short-selling attacks, high debt levels and frozen trading markets that make deleveraging difficult.

That means some of the real estate industry's biggest names – and now troubled ones – will be represented by newcomers at the annual Mipim conference, which starts on Tuesday in the French Mediterranean city. From his SBB in Sweden to Germany's Adler Group SA, landowners representing a heady era are under new leadership.

Shareholders and creditors are hoping the newcomers can help lift the company out of its current woes.

For some companies, like René Benko's Cigna Group, it's already too late. It is unlikely that the once-familiar yacht, clad in the company's colors, will appear at Cannes.

Niamh Brennan, from University College Dublin's Center for Corporate Governance, said turnover could be a “red flag”. “Changes like interest rate hikes in well-governed companies should not lead to high levels of retirement. Directors' job is to manage risk, and that is part of their normal job.”

At SBB, founder Ilya Batozyan stepped down as chief executive in June, and there have been a number of other changes since then as the company tries to manage its debt. It is also under pressure from private investment firm Fir Tree, which is seeking repayment of bonds due to alleged violations of terms.

Firtree questioned the board's actions in December. In the same month, two members left the group due to health reasons and time constraints.

Meanwhile, Batryan himself is running for re-election to the board, which Green Street analyst Peter Papadakos said is “suboptimal.”

Also read: Open House: Hong Kong's Cheapest Luxury Homes Have Big Pitfalls

“Even after such poor performance, best-in-class corporate governance practices are clearly lacking in some cases,” he said. “The lack of activity in Europe versus the US is generally unhelpful.”

A representative for SBB declined to comment.

The story of cancellations is being repeated with other Scandinavian landlords. The CEO and CFO of Swedish company Oscar Properties have resigned in recent weeks.

Meanwhile, troubles at Malmö-based major residential landlord Heimstaden Bostad AB spilled over to Swedish pension fund Alekta, reducing the value of its shares by SEK 8.7 billion ($850 million) in the fourth quarter. . Alecta is currently struggling to appoint a new chairman after two failed attempts. In 2023, it lost its CEO after disclosing losses on bets against regional U.S. banks.

investment opportunity

But while many executives may miss out on the Cannes sunshine, some have used the predicament as an opportunity to start new ventures. Chad Pike, Blackstone's former head of European real estate, has launched Makorara to focus on private real estate debt and equity, PERE reported, citing launch documents.

He said there was a “huge cyclical investment opportunity” in resetting commercial real estate valuations.

Michael Abel, formerly an equity partner at TPG Inc., has launched Greykite, a European real estate company backed by Capital Constellation.

This is a “very attractive point in the investment cycle,” Abel said. “While levels of uncertainty and disruption are increasing, opportunities are abound.”

adler crisis

Some of those opportunities may also exist in Germany, which is struggling with its own wealth problems. At Adler, another short interest target, four board members, including the co-chief executive officer, resigned in 2022 after a forensic audit failed to disprove a series of allegations against the company.

Stefan Kirsten, a German real estate mogul who rose to prominence as financial director of mega-landlord Vonovia SE, was brought in to help settle matters as Mr. Adler's new chairman. However, doctors are still advising him to resign from the company, and the company remains in crisis.

Another German apartment operator, Peach Property Group AG, saw board chairman Reto Garzetti resign in October, along with another board member, citing disagreements over strategy. The company is rushing to reduce its debt as relative debt increases due to the rapid decline in prices.

Also read: Will Canada's housing ban on foreign buyers impact demand from Indians who are not resident in Canada?

There have also been changes at German landlord Corestate Capital Holding SA. The company was once a target of short seller Muddy Waters, but has since restructured with a debt-for-equity swap.

Adler, Corestate and SBB also deny the short sellers' allegations. Adler stock is down 98% since the initial attack, SBB is down 91%, and Corestate is down 99%.

–With assistance from Gina Turner.