Sales are up significantly and ROAS is very strong across search, social, and e-commerce.

At least, that's what the ad platforms claim.

However, when we take a closer look at brands' primary source of actual sales data, their CRMs, we see no spike in site traffic or engagement from search or social.

This is a relatively common occurrence at a small shoe manufacturer I spoke to recently.

The company, which makes shoes and sandals for corporate events and parties, has a consumer site and a separate wholesale site, with different services and lower prices.

But there's something else different about wholesale sites. That means being walled off from the attribution overload of advertising platforms.

According to the founder, business salespeople and business buyers can create deals directly that end up going through the DTC site.

But even when salespeople and customers meet in person, exchange multiple emails, or talk on the phone, walled garden platforms, i.e. Google and Meta, often allow those sales to be transferred to their own platforms. It claims to have been brought to you by the above advertising campaign.

“I don't know how they do it,” the founder said. “I'm not mad. That's great,” he added (with a nod to Will Ferrell).

Attribution and contribution

This is not a phenomenon specific to that shoe manufacturer either. The problem of platform over-attribution is prevalent across categories.

subscribe

AdExchanger Daily

Get our editor's roundup delivered to your inbox every weekday.

For app developers and other mobile performance marketers, the big three (Apple, Google, and Meta) operate an opaque system. They reach billions of people and claim credit for conversions associated with their ads, sometimes going back weeks, even if they only appeared half-way in someone's potential field of view for a few seconds. To do.

Two mobile game developers lament the current state of marketing, saying even app developers whose sales and downloads are declining can claim greater and greater success in platform attribution reports. It seems that there is.

Grocery brands are faring even worse. They are dealing with a proliferation of retailer-owned media networks that operate like walled gardens, all hell-bent on stealing all the money they can sell.

This dynamic means that marketing data can be completely disconnected from reality.

Grocery stores and consumer goods brands can sell their products to Google, Meta, Amazon, Walmart, Target, Kroger and any other small retail network without any reasonable connection to their seasonal or monthly business. You may see attribution conversions. performance.

For example, sales for a particular brand may always drop in April or pick up just before Valentine's Day. One retail media agency buyer said attribution for ad platforms should go hand in hand.

Instead, ROAS reporting moves up and to the right as advertising platforms hone their targeting skills or simply claim 100% attribution to sales with a small, if not 0%, contribution.

This trend directly impacts brands' profit margins, as brands pay more for sales attributed to ad campaigns than organic conversions.

Incentive issues

Incentive issues

Fortune 500 beverage brand marketers recently reported that they feel that major search and social platforms such as Google, Meta, Amazon, and Apple are treating advertisers' organic sales as a growth opportunity for their respective platforms. told me.

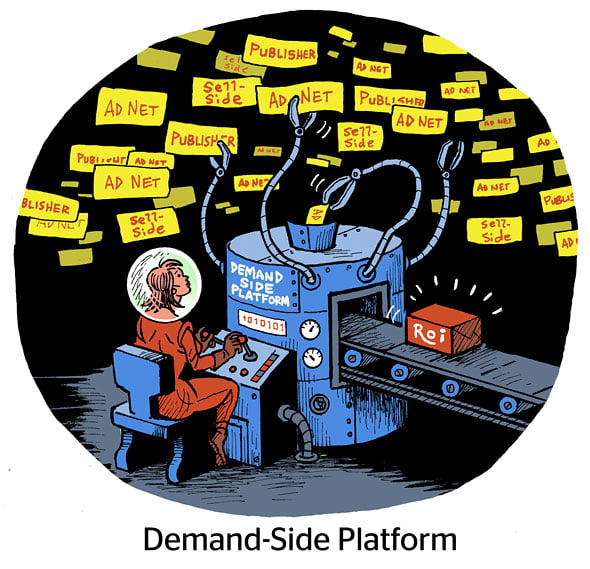

The retailer's DSP, Walmart Connect, is reaching more people with new channels, she said. In short, this would result in a measurable increase in new beverage sales for her company.

Emphasize “some.” Because as Walmart Connect strengthens targeting and attribution, brands will grow by claiming more of their organic sales as their own ROAS.

“Walmart can't just significantly increase its beverage footprint,” she says. While the company's advertising platform may contribute to net new sales, Walmart's real opportunity is actually the low-hanging fruit waiting to be picked, but more and more sales happening at Walmart. It is to claim belonging to.

The same goes for Amazon, she says, but on steroids.

Krzysztof Franaszek, founder and CEO of Adalytics, said in March that after releasing a report on MFA supply, Amazon's off-site advertising platform was “pulling up its Manufactured Ads (MFA) inventory on the web.” I'm circulating it,” he said.

However, these listings do not encourage purchases. The ads are being placed on sites trafficked by chumbox and are being served with completely malicious intent. However, Amazon claims attribution credit for purchases on its site as long as the customer receives an impression within a certain attribution window.

Remember the old shoe maker? He speculated that sales from direct sales reps were likely due to Gmail ads. The company uses Google's P-MAX, which buys the entire Google service, including Gmail, but does not say exactly where those ads are placed. The customer may have searched for the company while on the phone with the salesperson and associated the ad right before making a big purchase.

However, he added, “I don't know how Meta achieved self-attribution.'' [that] The sale comes as a big ROAS day for the company's advertising platform. That's what we did. ”