Bitcoin was exfiltrated from the Mt. Gox exchange in the past day, raising concerns about a potential bearish effect. Here is what analysts have to say:

Mt. Gox has conducted multiple Bitcoin transactions in the past 24 hours

Over the past day, multiple wallet activity linked to the bankrupt cryptocurrency exchange Mt. Gox has been spotted on the Bitcoin blockchain, likely linked to the platform's recent announcement of a repayment plan for creditors.

Mt. Gox moved a total of 137,890 BTC, which is worth about $9.4 billion at the current cryptocurrency exchange rate. These moves have raised concerns in the market about whether these tokens will be traded, leading to increased selling pressure in the market.

As a result, BTC prices have fallen by around 4% in the past 24 hours. So far, the market has reacted negatively to the news, but some are questioning whether these withdrawals will actually be bearish.

Analyst James Van Straten discussed this in a post on X, offering his views on how the potential sell-off resulting from these repayments compares to another sell-off that BTC recently witnessed.

The distribution event in question is from long-term holders (LTH), who make up one of the two main sectors of the BTC market based on holding period.

All investors who have held coins for more than 155 days fall into this group, while those who bought within the past 155 days fall into the short-term holders (STH) group.

LTH is considered to be the resolute side of the market as it rarely participates in selling, while STH is a wayward investor who regularly reacts to sector events with panic selling.

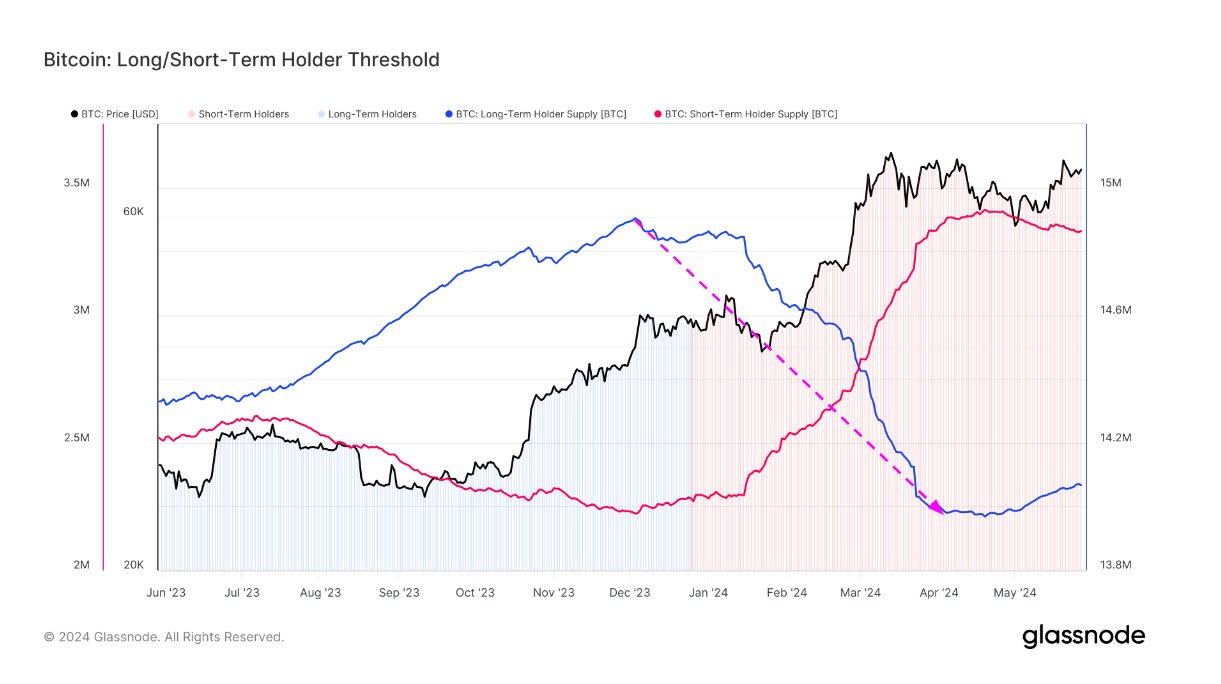

However, the recent rise in the asset's price has proven enough to spur even these HODLers to sell. The chart below shows their total supply.

As the chart shows, LTH supply has been trending flat in recent months, but was declining for the five months prior.

In this offering, LTH sold approximately 1 million tokens, of which approximately 340,000 BTC was associated with the outflow of GBTC. At the same time, this distribution from LTH occurred, the coin's price was reaching new all-time highs, suggesting that the market was able to absorb this massive selling pressure well.

Straten noted that Mt. Gox's payout is only about one-tenth of the amount in the sale, and that not everyone who acquired these tokens will decide to sell them — or at least not all at the same time.

Therefore, taking this fact into account, if demand for cryptocurrencies remains as strong as it has been recently, Bitcoin may not be affected by this distribution.

BTC Price

Bitcoin had previously surpassed the $70,000 mark, but the Mt. Gox news caused the asset's price to fall to $67,700.

Featured image from Dall-E, Glassnode.com, chart from TradingView.com