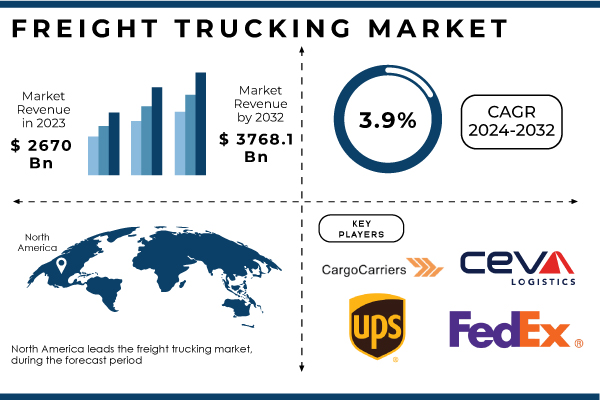

PUNE, July 08, 2024 (GLOBE NEWSWIRE) — Freight transport market size It is expected to reach USD 267.0 billion in 2023 and grow at a CAGR of 3.9% over the forecast period 2024-2032, reaching USD 3768.1 billion by 2032.

The expanding e-commerce sector is a major driver of the freight forwarding market, with online shopping creating a huge need for efficient door-to-door freight transportation. Customers require fast and reliable deliveries, forcing logistics companies to streamline processes and utilize strong trucking networks. Additionally, the demand for freight forwarding services is also driven by the growing focus on just-in-time inventory management across many industries. JIT practices require accurate and timely delivery of raw materials and finished goods, and a reliable trucking network is essential for smooth business operations. for exampleIn China, a strong export network is boosting demand for heavy trucks, with sales expected to reach 81,000 units in 2023, up 68% from a year earlier, according to the China Association of Automobile Manufacturers.

Additionally, various companies are taking steps towards acquisitions and mergers to focus on innovation and expansion in the cargo truck market.

Get a sample report Cargo market @ https://www.snsinsider.com/sample-request/3923

March 2023DSV has acquired two U.S.-listed logistics and freight forwarding service providers, S&M Moving Systems West and Global Diversity Logistics, in a transaction structured to add depth to the growing semiconductor industry, complement new operations at Phoenix-Mesa Gateway Airport, and support cross-border services to Latin America.

In addition, Fortem International has announced Kuehnenagel as the official logistics service provider for four international trade fairs in 2023. Under the agreement,Kuehne Nagel As the exclusive distributor of end-to-end logistics MES, Sensible has announced that as part of its commitment to providing sustainable logistics solutions, Fortem International To reduce the fair's carbon footprint.

Recent developments

February 2024 – Rider We have acquired Cardinal Logistics, a North American dedicated fleet truck provider, strengthening our position as one of the leading designers specializing in direct customized giving carriage (DCC) services..

January 2024 – RXO Release AI-powered truck check-in technology for warehouses and distribution centers. The system uses video to recognize trucks and collect data to make the check-in and security process more convenient.

October 2023 – AP Moller-Maersk and Kodiak Robotics Together, we will deploy the world's first commercially available autonomous truck lane between Houston, Texas and Oklahoma City, heralding a new era of driverless heavy-duty truck adoption.

Cargo market Report Scope and Overview:

| Report Attributes | detail |

| Market size in 2023 | US$2670 billion |

| Market size in 2032 | US$3768.1 billion |

| CAGR (2024-2032) | 3.9% |

| Report Scope and Coverage | Market size, segment analysis, competitive landscape, regional analysis, DROC and SWOT analysis, forecast outlook |

| Market Drivers |

|

Need to research customization? Cargo marketTalk to an analyst @ https://www.snsinsider.com/enquiry/3923

Segment Analysis

By truck type: of Dry Van Segment It will lead the market with a revenue share of around 40% by 2023, due to its versatility in carrying consumer goods as well as groceries. Due to its popularity in shipping fresh goods, the market has grown by around 25% over the past five years. North America currently accounts for around 30% of the market share for dry van containers, according to Global Market News.

By vehicle type: Heavy commercial vehicles As a result of globalization and significant rise in e-commerce, automobiles are the market leader in this segment, accounting for more than 30% of the revenue share during the forecast period. Models including heavy trucks and tractor-trailers cater to the huge demand for cargo transportation in various business sectors.

By End User: Agriculture Perishable goods require efficient transportation solutions and hence, were to capture the largest market share by end use in 2023. The growth of this segment is driven by the need for time- and temperature-controlled deliveries required by food, agriculture, and other businesses.

Regional Analysis:

North America dominates the global freight trucking market, driven by a strong road transport network and technological advancements in logistics. The Asia-Pacific region is emerging as the fastest growing region, supported by growing trade activities and infrastructure investments.

North American freight trucking companies are introducing a series of technological innovations to increase operational efficiency. This allows IoT-integrated rail vehicles, tracks, and cargo to track their performance and operating conditions, allowing any failure modes to be addressed immediately to enhance proactive decision-making. Blockchain technology ensures transparency and security in logistics and improves the communication process between all participants. Advanced analytics and big data are used to optimize operations, predict maintenance requirements, and improve asset performance. Automation technologies such as self-driving trucks and drones are being explored to improve safety, shorten delivery times, and reduce emissions. The transition to electric trucks is largely driven by the desire to reduce emissions and lower maintenance costs.

Europe and other regions will also see significant growth due to an increase in e-commerce platforms and port expansion.

Buy Enterprise User PDF Freight Market Outlook Report 2024-2032 @ https://www.snsinsider.com/checkout/3923

Key Takeaways

- Rapid globalization and the expansion of e-commerce are driving the growth of the freight trucking market.

- Technological advancements in fleet management improve operational efficiency.

- Increasing demand for just-in-time delivery will drive the adoption of freight trucking services.

- Geographic expansion and strategic acquisitions shape market competitiveness.

- Sustainability initiatives and regulatory measures will influence market trends.

Table of Contents – Main Points

1.First of all

2. Industry Flowchart

3. Research Methods

4. Market Trends

4.1 Drivers

4.2 Constraints

4.3 Opportunities

4.4 Challenges

5. Porter's Five Forces Model

6. Plague Analysis

7. Segmentation of the freight trucking market by propulsion type

8. Freight Trucking Market Segmentation (By Vehicle Type)

9. Freight Transportation Market Segmentation by End Use

10. Regional Analysis

11. Company Profile

12. Competitive Environment

13. Use Cases and Best Practices

14. Conclusion

Access the complete report details @ https://www.snsinsider.com/reports/freight-trucking-market-3923

About SNS Insider

At SNS Insider, we believe that businesses of all sizes and industries should have access to the best market intelligence and insights. That's why we offer a range of solutions tailored to meet the unique needs of each client, from startups to large enterprises. With a passion for our work and an unwavering commitment to delivering value, we are committed to helping our clients realize their full potential.