- The integration phase is officially over.

- DIA's value is likely to double, and investors may consider buying opportunities.

diamond [DIA] He has been performing well in recent weeks. The $127 million market cap asset has persisted through bear markets since 2022 and has defended the $0.35 support zone since May 2022.

The breakout above the $0.81 and $1 levels was a noteworthy development. This breakout above the highs from March indicates that the token has exited the consolidation phase of the bear market.

There seems to be ample potential for price expansion northward.

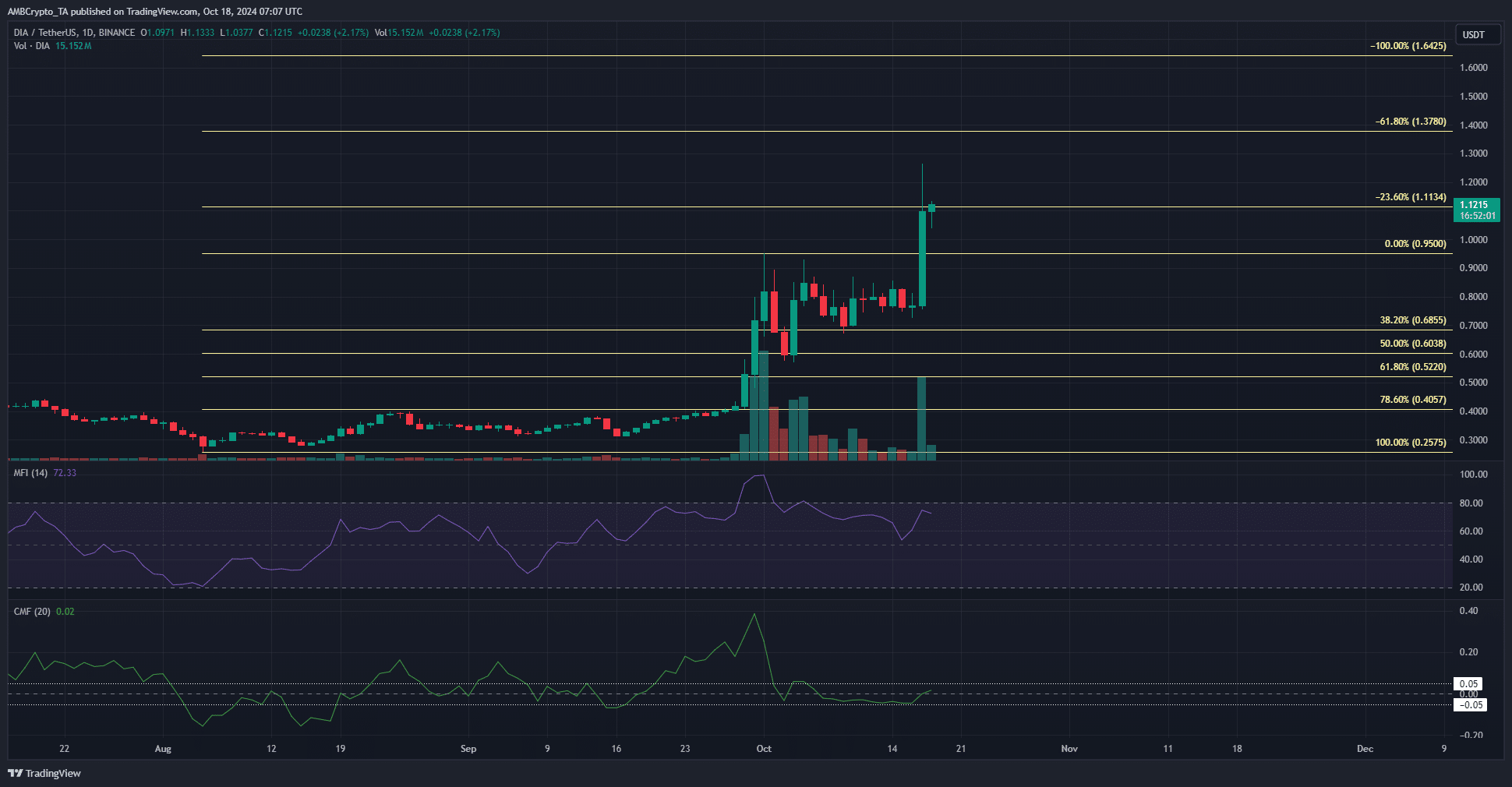

Source: DIA/USDT on TradingView

Fibonacci extension levels were plotted based on the rise of the DIA cryptocurrency since August. This rally quickly gained momentum towards the end of September, with the token gaining 134% in three days before falling.

At the time of writing, the 23.6% extended level of $1.11 was under attack. DIA bulls could push the price higher. If rejected, it could become a buying opportunity if the price drops to $0.95-$1.

Although the RSI showed strong bullish momentum, the CMF remained at +0.02, indicating that the buying pressure is positive but not high. Further north, the $1.37 and $1.64 levels could be the next resistance.

Short-term bullish sentiment goes haywire

Source: CoinAnalyze

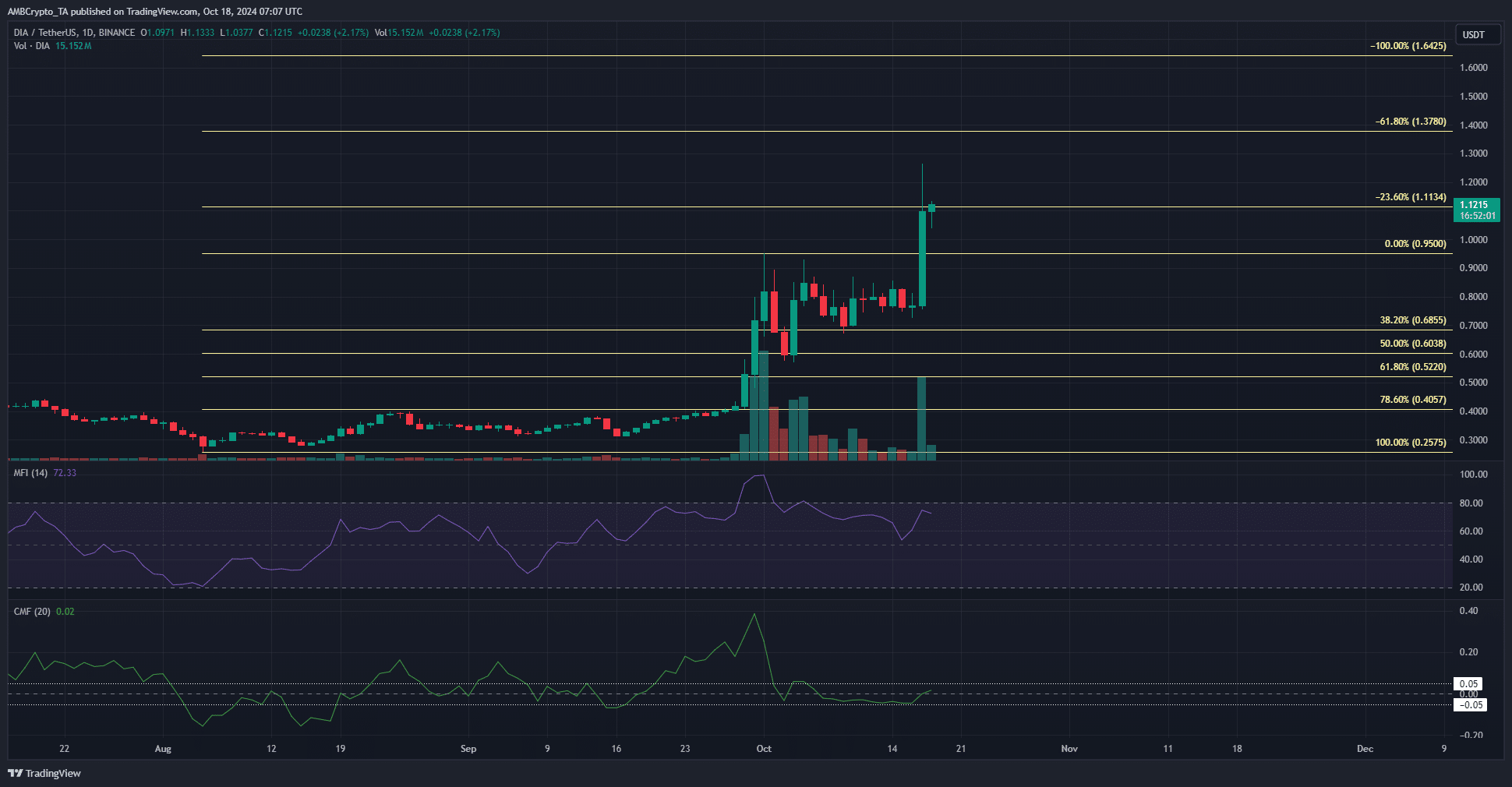

On the morning of October 17th, open interest was $3.4 million and DIA was trading at $0.79. After 6 hours, the price was $1.12 and the OI was $24 million. This influx of OIs highlighted the speculative frenzy.

Realistic or not, DIA's market cap in BTC terms is:

Although the spot market has seen a strong rally, the large increase in OI within 24 hours could lead to high volatility for the token. Investors and traders need to exercise caution and tighten risk management.

Disclaimer: The information presented does not constitute financial, investment, trading, or any other type of advice and is solely the opinion of the author.