The Atlanta Fed's Commercial Real Estate Market Index (CREMI) provides information on the general commercial real estate (CRE) situation in more than 350 U.S. cities and adjacent communities. Overviews of multiple asset types, including hospitality, industrial, multifamily, office, and retail, serve as a starting point for assessing market risk and performance.

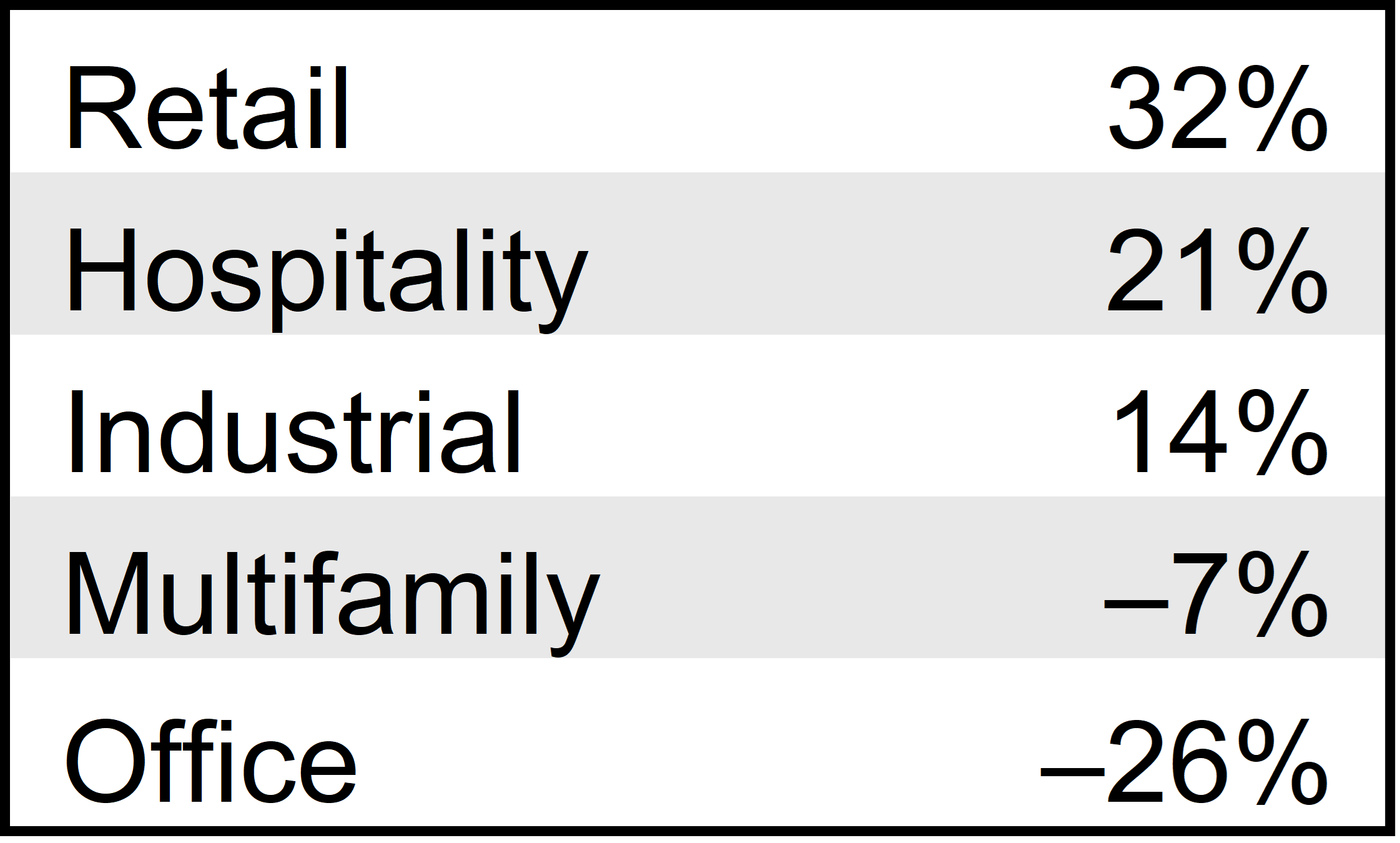

The commercial real estate situation remained mixed. Average sector scores show that hospitality (21%), industrials (14%), and retail (32%) are outperforming their long-term averages. Multifamily and office indicators continue to lag, remaining 7% and 26% below their long-term averages, respectively (see Table 1).

Table 1: Performance against CRE segments and long-term averages

Source: Federal Reserve Bank of Atlanta's CREMI

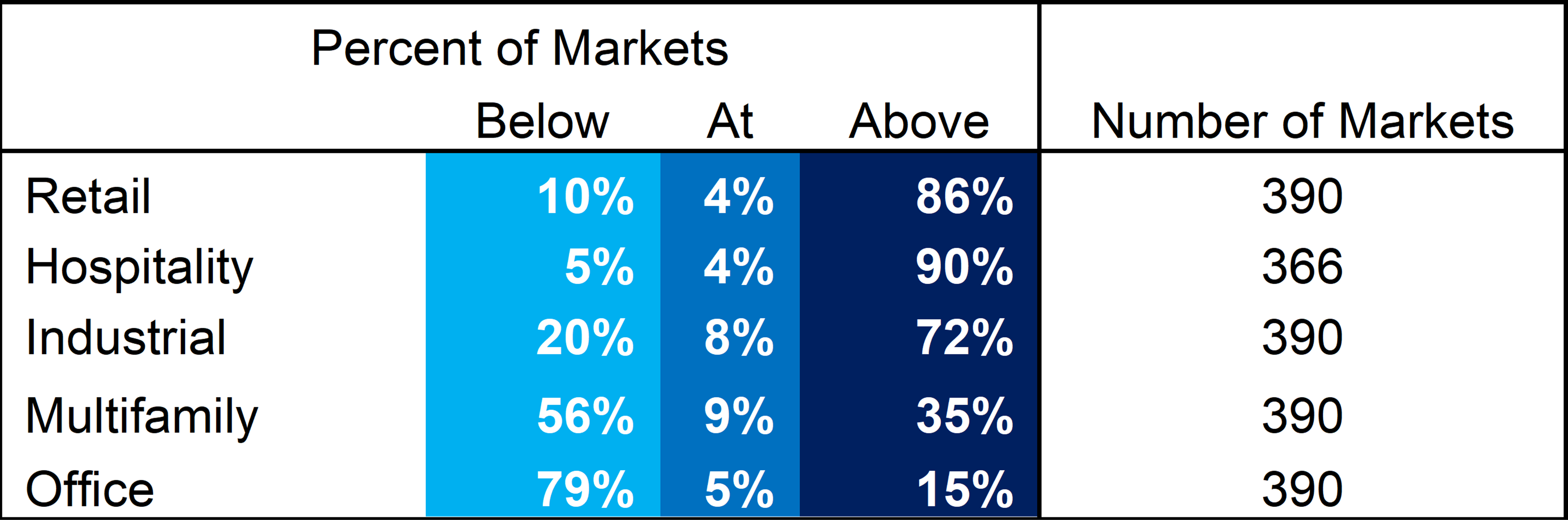

Of the more than 350 U.S. markets sampled in CREMI, hospitality (90 percent), industrial (72 percent), and retail (86 percent) are outperforming their long-term averages, with mostly positive performance. (see Table 2). In contrast, the proportion of multifamily (35 percent) and office (15 percent) outperforming the long-term average indicates that fewer markets perform relatively well over the long term. Most multifamily properties (56 percent) and offices (79 percent) are performing below their long-term averages, indicating performance lag.

Table 2: Long-term average performance of CRE segments

Source: Federal Reserve Bank of Atlanta's CREMI

Hospitality (21% above long-term average performance)

- Healthy business travel continues to improve revenue per available room (RevPAR) in the luxury hotel sector.

- Cost-conscious consumers are impacting lower-tier hotel segments.

Industrial (more than 14%)

- Rising vacancy rates are impacting the industrial situation. These vacancy rates have rebounded from a significant decline in 2022 brought about by rising construction levels.

Multifamily housing (7% or less)

- The multifamily situation continues to be challenged by a combination of oversupply (in the luxury/luxury segment) and affordability issues.

Office (26% or less)

- The office landscape continues to be affected by a combination of remote work, worker shortages, and oversupply.

- Low-rise office buildings appear to be bearing the brunt of the continuing changes facing the office sector.

Retail (over 32%)

- Due to strong leasing and minimal new construction, factors such as vacancy rates remain at stable levels, and the overall retail industry remains generally healthy.

conclusion

CREMI results show the relative performance dispersion between asset classes in Q2 2024. Oversupply factors in office and multifamily housing have caused many markets to underperform their respective indexes' long-term averages. Consumer behavior, overall balanced supply, and economic health have led many retail, hospitality, and industrial markets to outperform their long-term CREMI averages. Interested in tracking the performance of a particular market or asset class? Click here to learn more.