Business travel volumes are expected to exceed pre-pandemic levels in 2024, according to Advantage Travel Partnership's latest Global Business Travel Review.

In partnership with travel data and reporting experts Travelogix, the sixth edition of the report includes analysis of 2023 booking data and forecasts for the next 12 months, as well as insights from travel experts on traveler and booker behavior. Contains insights.

The review examined data from 25.4 million records during 2023, representing a total trading revenue of £12.3 billion.

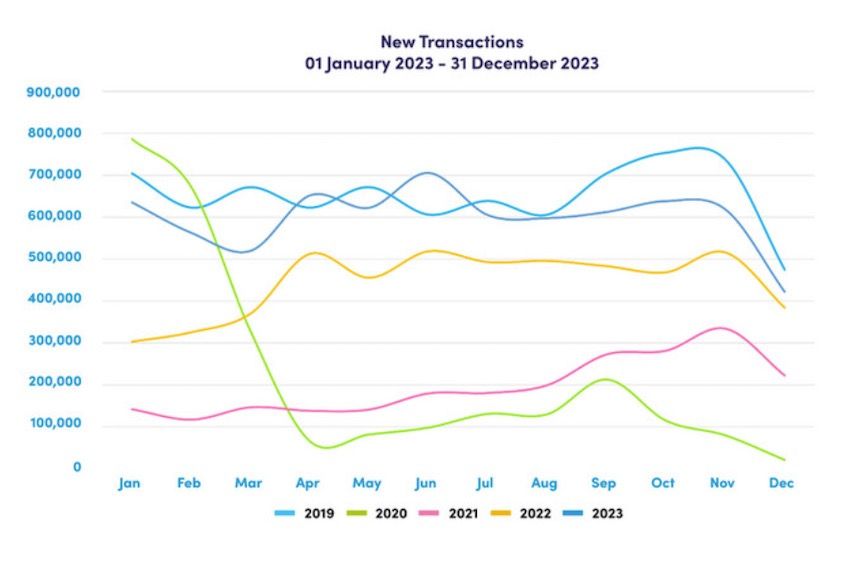

The results showed that bookings in 2023 are expected to reach 92% of 2019 levels, and in 2024 are expected to be “at least” 6.2% above pre-pandemic trading.

The report says 2023 can be considered a “point of future comparison” as the first stable year since the pandemic.

The average transaction value in 2023 was £429.35, 5.7% more than 2022 and 44.8% more than 2019. The average trip length was 6.95 days, slightly lower than the 7.9 days predicted in the previous September report. However, travel time in 2023 was still 51% longer than in 2019 (4.6 days).

Bookings for 2023 were made on average 28.6 days in advance of travel, down from the 33.1 days reported last September, but higher than 23.4 days in 2019.

The review also highlighted the increased focus on travellers' health following an increase in bookings for premium air travel. Premium cabins saw “significant growth” in 2023, accounting for 28.7% of all bookings (compared to an average of about 20% the previous year).

Commenting on the findings, Guy Snelger, Global Business Travel Director at Advantage Travel Partnership, said: “The travel disruption caused by the pandemic and its lingering effects has undoubtedly had a significant impact on the business travel industry. We're seeing that reflected in the business travel industry.” Data shows that long-distance travel is being booked and health is at the forefront of business travelers' duty of care.

“Despite current geopolitical tensions and economic uncertainty, the business travel market is booming and is expected to see strong demand from the corporate travel industry throughout 2024. Looking ahead “There's a lot to be optimistic about,” he added.

The latest review also features models that track pre-COVID-19 seasonality and trends, as well as models that combine seasonality and trends in 2023.

The model predicts that 2024 will be at least 15.5 percent higher than 2023 and at least 6.2 percent higher than 2019. Results for the first quarter of this year are expected to be at least 3.3% higher than the first quarter of 2019 and at least 20.2% higher than the first quarter of 2023.

Chris Lewis, Founder and CEO of Travelogix, said: “This feels like a landmark year for the travel industry. It should also be the year that business travel recovers for a full 12 months.”

This review also explores trends that are likely to shape the business travel landscape over the next 12 months, including the growth of blended travel and hybrid working models, the increased use of blockchain technology, and the potential for 'smart contracts' for electronic ticketing. We are investigating. Loyalty schemes and partnership agreements.