Get free access to our editors' top ideas and insights.

Bank economists have expressed cautious expectations that corporate lending will remain strong in 2024, with sentiment changing due to monetary policy.

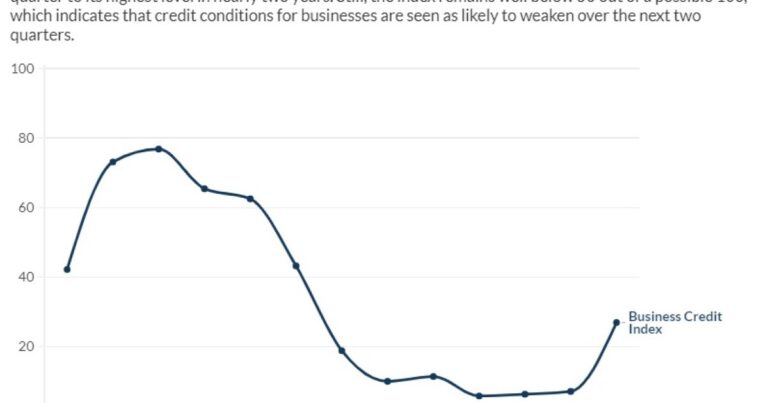

Although they still expect corporate credit conditions to worsen over the next six months, the sector's outlook remains strong in 2022, according to the American Bankers Association's latest Credit Conditions Index, which predicts the quality and availability of credit. It is said to have reached its brightest level since the second half.

ABA Chief Economist Seyi Srinivasan said current credit conditions were better than many expected, giving room for optimism about the future.

“If you go back more than a year, all economists, including economists, [Federal Reserve Board]”We were predicting that we would be in a recession by now, but that hasn't happened,” Srinivasan said. Credit supply and credit quality conditions. ”

The report is based on a survey of approximately 15 chief economists at large banks across the country who make up the ABA's Economic Advisory Council, and found that most respondents expect corporate credit quality to worsen in the coming quarters. Meanwhile, almost half indicated they thought the availability of business credit would improve. .

A reading below 50 is a measure of how the committee expects credit market conditions to worsen, with the Corporate Credit Index, part of the composite index, at 26.9 in the first quarter, an improvement of 19 points from the end of last year. did.

Srinivasan said banks did not reduce lending as much as expected in 2023, even though the ABA credit index predicts a deterioration in credit conditions. He added that the latest data shows banks will continue lending to businesses and consumers, especially if the Fed cuts rates as expected.

After a year of weak loan growth amid rising interest rates and industry uncertainty, many banks expect lending to be largely flat or only increase modestly in 2024.

Bank of America CEO Brian Moynihan said at an industry conference Wednesday that growth in commercial lines of credit is “an absolute dogfight right now” due to customer concerns about economic uncertainty. He said that it has become.

Additionally, office loans have recently come under scrutiny after New York Community Bancorp's stock fell 37% on the day the company announced its commercial real estate portfolio had taken a hit. Srinivasan said the ABA credit report remains at a high standard because the segments between financial institutions can vary widely.

Despite some turmoil in the commercial real estate market, most bank leaders continue to emphasize that they are satisfied with the quality of their portfolios. Recent data from IntraFi shows that

ABA also measures the temperature of consumer credit and overall “headline credit,” which were 11.5 and 14.8, respectively, in the first quarter. Consumer credit rose 9.8 percentage points from the previous quarter, but the outlook for the sector remains near record lows due to concerns about credit quality.