Even when a company is making a loss, it is possible for shareholders to make a profit if they buy a good company at an appropriate price. for example, corvus pharmaceutical (NASDAQ:CRVS) shareholders have had a very good year last year, with the stock soaring 226%. Nevertheless, only a fool would ignore the risk of a loss-making company running out of cash quickly.

Given the company's strong share price performance, we think it's worth considering for Corvus Pharmaceuticals shareholders whether the company's cash burn is a concern. This report examines the company's negative free cash flow for the year. We will refer to this as “cash burn” from now on. Let's start by examining the company's cash compared to its cash burn.

See our latest analysis for Corvus Pharmaceuticals.

Does Corvus Pharmaceuticals have long financing options?

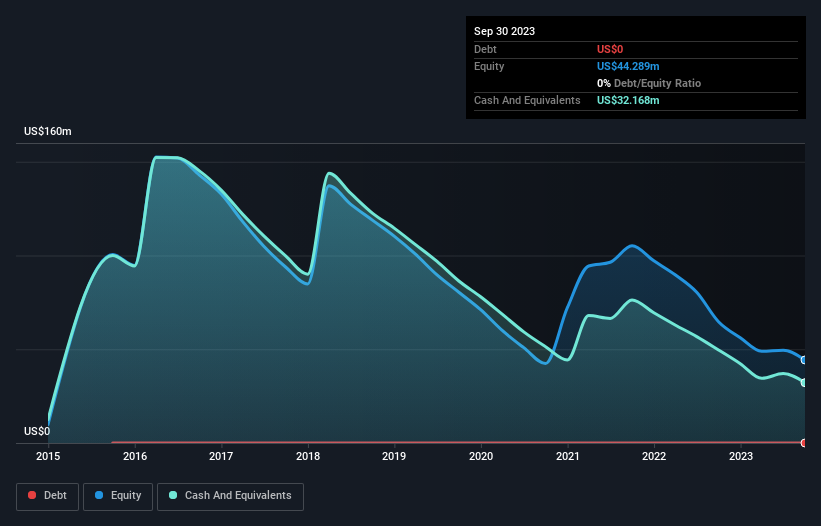

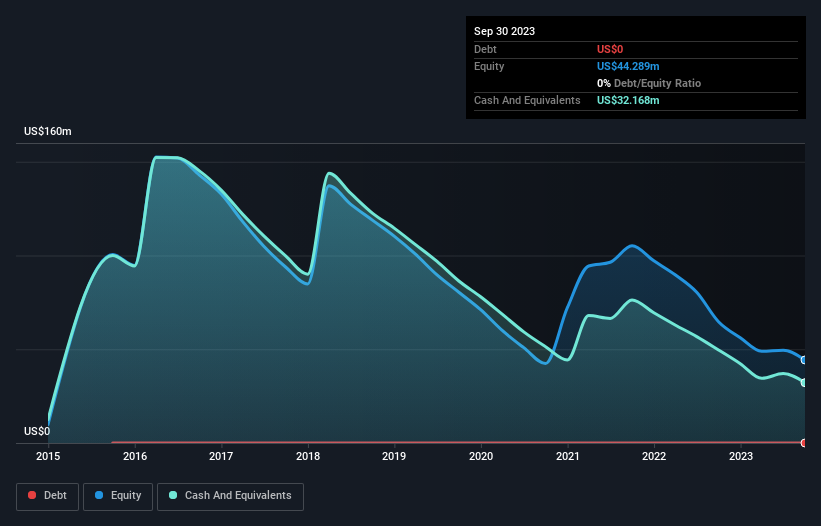

Cash runway is defined as the time it would take for a company to run out of cash if it continued to spend at its current cash burn rate. As of September 2023, Corvus Pharmaceuticals had cash of US$32 million and no debt. Importantly, his cash burn in the trailing twelve months was US$26m. So it had a cash runway of about 15 months from September 2023. This isn't too bad, but unless its cash burn significantly reduces, it's safe to say that the end of its cash runway is in sight. The image below shows how its cash balance has changed over the past few years.

How has Corvus Pharmaceuticals' cash burn changed over time?

Corvus Pharmaceuticals did not record any sales last year, indicating that the company is still an early stage company developing its business. So while we can't look at sales to understand growth, we can look at changes in cash burn to see how spending is trending over time. It seems the company is happy with its current spending, as its cash burn rate has remained stable over the past twelve months. However, it is clear that the key factor is whether the company will grow its business going forward. For this reason, it makes a lot of sense to see what analysts are predicting for the company.

How difficult will it be for Corvus Pharmaceuticals to raise more capital for growth?

Corvus Pharmaceuticals has shown that its cash burn has been steadily declining, but it's still worth considering how it could easily raise even more cash, if only to fuel faster growth. be. Generally, listed companies can raise new cash by issuing stock or taking on debt. One of the main advantages of publicly traded companies is that they can sell stock to investors to raise cash and fund growth. By comparing a company's annual cash burn to its total market capitalization, we can roughly estimate how many shares it would need to issue to run the company for another year (at the same burn rate).

The company's market capitalization is $104 million, so Corvus Pharmaceuticals' $26 million cash burn represents about 25% of its market value. This is a fairly significant cash burn, so if the company had to sell stock to cover next year's operating costs, shareholders would suffer significant and costly dilution. Dew.

So should we be worried about Corvus Pharmaceuticals' cash burn?

We have to mention that we thought Corvus Pharmaceuticals' cash runway was relatively promising, although its cash burn relative to market capitalization makes us a bit concerned. While we don't think cash burn is a problem, the analysis we've conducted in this article suggests that shareholders should think carefully about the potential cost of raising further capital in the future. . On a different note, Corvus Pharmaceuticals, Inc. 5 warning signs (and two potentially serious ones) that I think you should know about.

of course Corvus Pharmaceuticals may not be the best stock to buy.So you might want to see this free A collection of companies with a high return on equity, or a list of stocks that insiders are buying.

Have feedback on this article? Curious about its content? contact Please contact us directly. Alternatively, email our editorial team at Simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary using only unbiased methodologies, based on historical data and analyst forecasts, and articles are not intended to be financial advice. This is not a recommendation to buy or sell any stock, and does not take into account your objectives or financial situation. We aim to provide long-term, focused analysis based on fundamental data. Note that our analysis may not factor in the latest announcements or qualitative material from price-sensitive companies. Simply Wall St has no position in any stocks mentioned.