Concerns about the banking industry in the United States this week were sparked by the following factors:

- New York Community Bancorp cuts dividend due to tighter capital controls and commercial burdens

- Japanese banks report unexpected losses on US commercial real estate

- Deutsche Bank highlights losses in US commercial real estate

Despite all the economic data coming out this week, these headlines caused the 10-year US Treasury yield to drop 14 basis points this week.

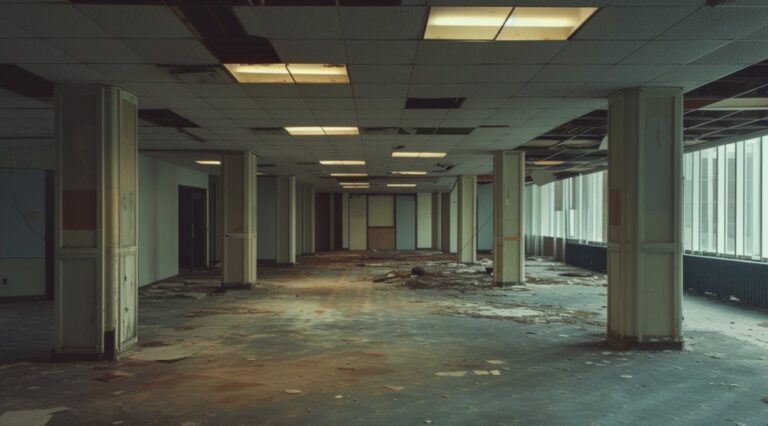

There are subprime echoes here, as no one really knows the scale of the problem, who is bearing the losses, or how they can be managed. What is clear is that office real estate has been severely damaged by the post-pandemic shift to working from home. Vacancy rates are high and tenants have incredible leverage in demanding rent reductions.

Banking rules require impairment when losses become reasonably foreseeable, but it is not yet clear how many employees will be brought back to the office or how many companies will exit. However, it has not actually been realized yet.

No matter the situation, there is no doubt that losses will be large. How high? Goldman Sachs estimates that $1.2 trillion in commercial mortgages will mature this year and next, about a quarter of all commercial mortgages outstanding, the most since 2008. This is the highest standard.

The largest single holder is a bank with a 40% share. Other estimates put the “maturity wall” at $1.5 trillion, according to Reuters.

“The office market is currently in an existential crisis,” Barry Sternlicht, CEO of Starwood Capital Group ($115 billion in assets under management), said at the Global Alts Conference. Told. “This is a $3 trillion asset class, probably worth $1.8 trillion. $1.2 trillion in losses are spread out somewhere, but no one knows exactly where.. ”

For example, in 2007, the total size of the U.S. subprime mortgage market was $1.3 trillion.

There are two factors that make this a particularly dangerous situation.

- Smaller/local banks bear most of the losses and do not have the capacity to take much pain.

- Due to losses in the held-to-maturity bond market, new financing is prohibitively expensive and often impossible

There's a reason the bond market quickly became very volatile this week.