Bitcoin BTC and the cryptocurrency have soared over the past year, and traders are now eyeing unexpected developments in China as the next price move.

Subscribe now Forbes Crypto Assets and Blockchain Advisor And ahead of next year's historic Bitcoin halving, we will “unveil blockchain blockbuster products that can expect profits of over 1,000%”!

The price of Bitcoin has settled at just over $40,000 per Bitcoin, and has risen almost 200% since crashing to a recent low of about $15,000 at the end of 2022 (although billionaires' investments Mark Cuban has revealed that he is betting on these two small-cap cryptocurrencies).

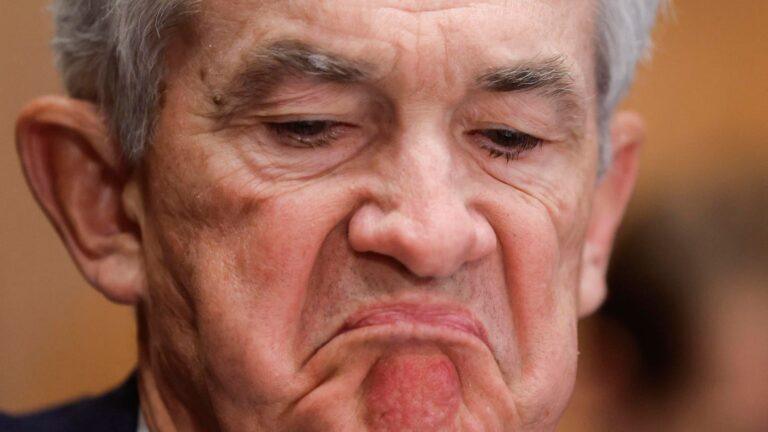

Now, with Federal Reserve Chairman Jerome Powell hinting that U.S. interest rates will start to fall in the second half of this year, hedge fund manager Anthony Scaramucci is predicting that the price of Bitcoin will drop by 1 after April's supply cut. We predict it will skyrocket to at least $170,000 per Bitcoin, which will give Bitcoin a market. The capital is approximately $3.3 trillion.

Bitcoin's historic halving, which is expected to cause turmoil in cryptocurrency prices, is just around the corner. Sign up for free now crypto codex—Stay ahead of the market with our daily newsletter for traders, investors, and anyone interested in cryptocurrencies.

“Let’s look back at the Bitcoin halving cycle,” Scaramucci, the founder of Skybridge Capital who briefly served as former President Donald Trump’s communications director, said in a speech. podcast With trader Scott Melker.

“On the day when Bitcoin is halved, quadruple it.” [and] It's incredible that 18 months later, that's the price of Bitcoin. I'm using a figure of $35,000 for the halving, which is conservative…let's say in April he's $50,000. That would give you a handle of $200,000. If his current price is $60,000, that's $240,000. ”

Bitcoin's next halving, the fourth, will see the number of Bitcoins issued to so-called miners reduced to 3.125 Bitcoins from just over 6 Bitcoins today, in exchange for network security.

“My long-term price goal is for Bitcoin to easily reach half the market cap of gold,” Scaramucci said. “Gold is currently $14.5 trillion. If Bitcoin goes to $7 trillion or $8 trillion, it will go 10x from there. , I think it's stupid not to understand the dynamics of that “as a store of value, not to have status.'' ”

Meanwhile, traders are preparing for a Fed rate cut that could signal the start of quantitative easing around the same time as Bitcoin's halving.

Sign up now crypto codex—Free daily newsletter for those interested in cryptocurrencies

“Bitcoin prices have realigned with interest rate expectations in the futures market, suggesting that Bitcoin will become more sensitive to interest rate-sensitive macro data such as salaries and salaries.” [consumer price index]Especially as the excitement surrounding ETFs wanes,” said James Butterfill, head of research at CoinShares. block Following Powell's press conference, he mentioned a group of Bitcoin spot exchange-traded funds (ETFs) that began trading last month.

“The first interest rate cut marks the start of quantitative easing, and it is very important what the macro context is at that particular moment,” Ruslan Rienka, head of markets at crypto firm Ukhodler, said in emailed comments. ” he said.

“If the economy goes into recession at that point, investors will try to move their money into bonds and money markets as soon as possible to lock in high interest rates for the next few years, so stocks and many other markets However, in the case of a soft landing, we would expect the market to grow and see an influx of cheaper capital in the near future, leading to an increase in risk assets.”

follow me twitter.