About 9 in 10 U.S. adults say: In the Post poll, six distinct indicators of economic security and stability were necessary for becoming middle class. A minority believed other milestones were needed, such as homeownership and a job with paid sick leave.

“Middle-classness and predictability are deeply tied to the American imagination,” said Caitlin Zaloom, an anthropology professor at New York University. “Sometimes it's about safety now, but sometimes it's about peace of mind about what life is going to be like.”

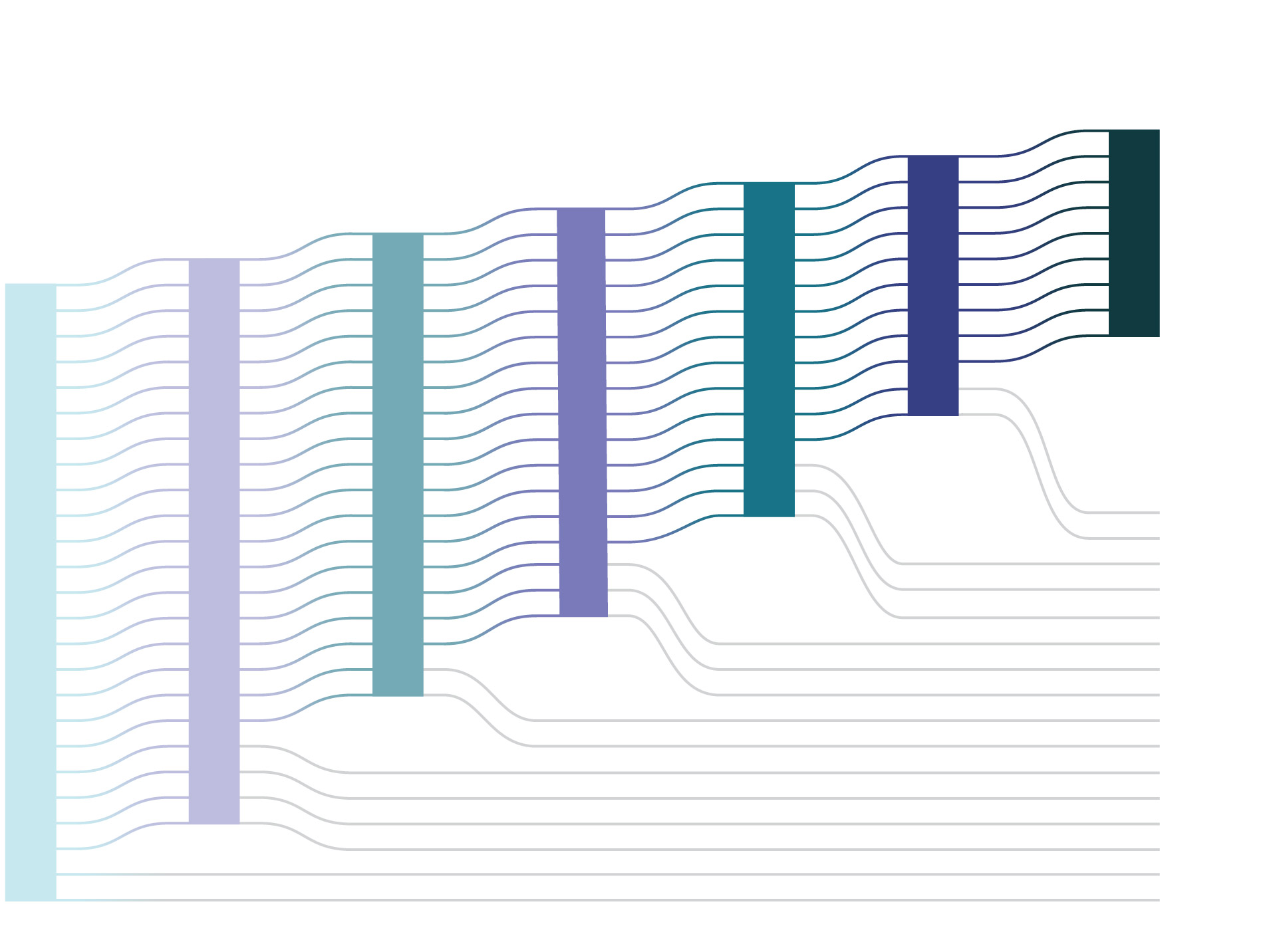

More than one-third of Americans met all six indicators of a middle-class lifestyle. About 9 out of 10 Americans had health insurance, but only three-quarters had health insurance and had regular jobs. With each tightening of economic safety nets, more Americans moved away from middle-class ideals.

About one-third of Americans meet middle-class standards

According to a Washington Post poll, approximately 90% of Americans agree that these six individual conditions are necessary to belong to the middle class.

…Health insurance available…

…and stable employment…

…Who can you save for?

future…

… I can afford it.

emergency

Expenses…

…and retire

Comfortable.

65% do not meet all

middle class standards

Source: 2022 Household Survey

and decision making

About one-third of Americans meet middle-class standards

According to a Washington Post poll, nearly 9 in 10 Americans agree that these six conditions are necessary to belong to the middle class.

…Health insurance available…

…and stable employment…

…Who can save for the future…

…there is room for emergencies.

Expenses…

…and retire

Comfortable.

65% do not meet all

middle class standards

Source: 2022 Household Economics and Decision Making Survey

About one-third of Americans meet middle-class standards

According to a Washington Post poll, nearly 90 in 10 Americans agree that these six individual conditions are necessary to belong to the middle class.

…Health insurance available…

…and stable employment…

…Who can save for the future…

…pay your bills without worry…

…there is room for emergencies.

Expenses…

…and retire

Comfortable.

65% do not meet all six criteria for being middle class.

Source: 2022 Household Economics and Decision Making Survey

About one-third of Americans identify with the popular image of the middle class.

According to a Washington Post poll, about 9 in 10 Americans agree that these six individual conditions are necessary to belong to the middle class.

…and retire

Comfortable.

…there is room for emergencies.

Expenses…

…pay the bills

Don't worry…

…Who can save me?

For the future…

…and steadily

employment …

…with good health

insurance …

Source: 2022 Household Economics and Decision Making Survey

Researchers often define the middle class based on income, in part because income data is frequently collected and easily accessible. However, that income does not guarantee a middle-class lifestyle.

One commonly used definition from the Pew Research Center defines middle-class income as two-thirds to twice the national median income, or $67,819 to $203,458 for a family of four in 2022. It is set between. Most Americans consider the lower end of that range to be $75,000. According to a Post poll, it costs $100,000 to become middle class.

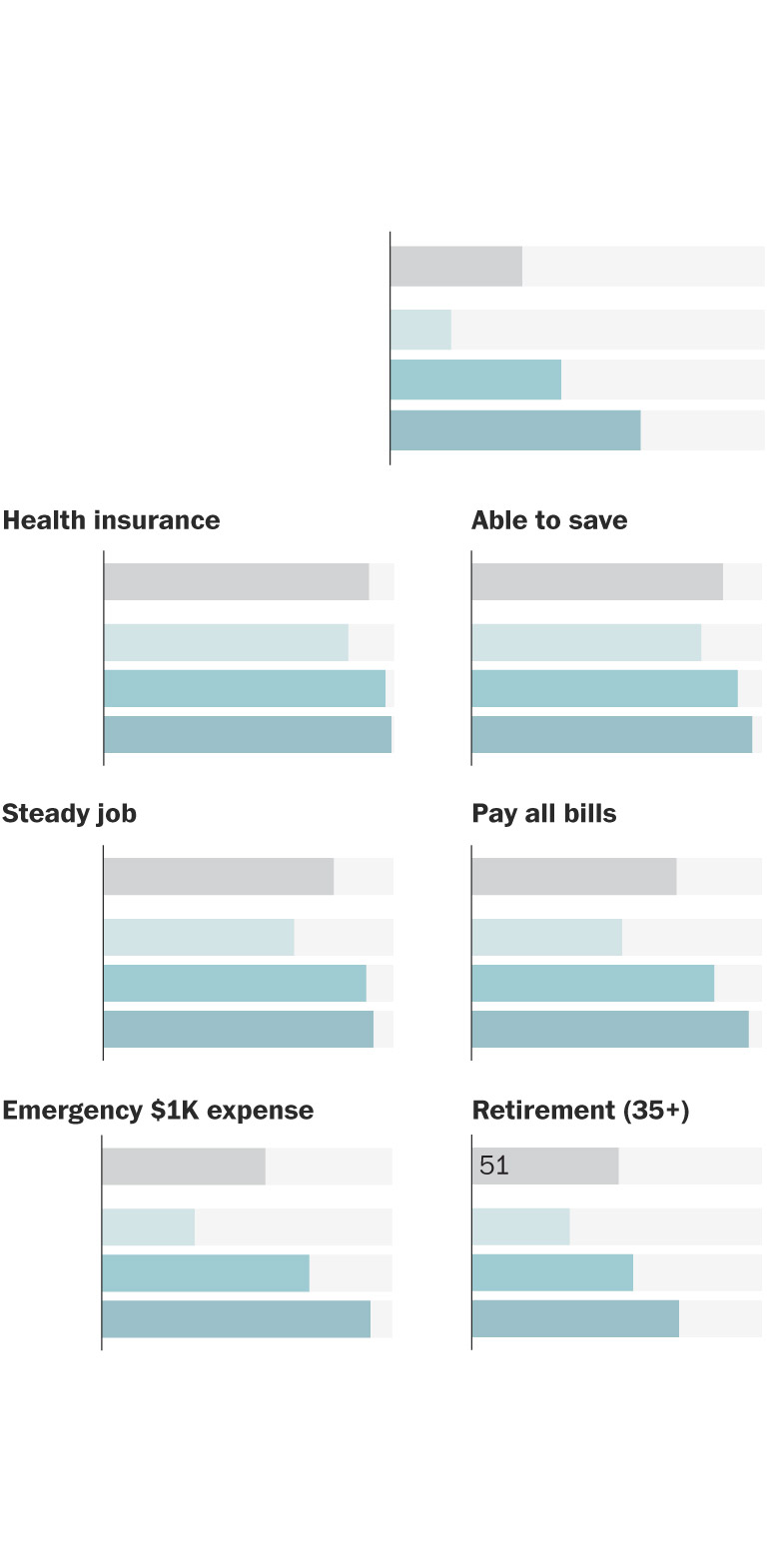

Even when we looked at middle-income Americans using Pew's broader scope, the majority did not have the sense of security that comes with being middle class.

They were more likely to be older, have higher incomes, have a college education, and own a home. A Post poll found that 60% of Americans believe homeownership is essential to becoming middle class, but a Federal Reserve survey found that even when compared to people of similar age and income, , homeowners over the age of 30 are more likely to be financially secure.

The most common barrier was a comfortable retirement, and about half of middle-income Americans age 35 and older felt they had achieved it.

Most of the middle-income group lacks

middle class economic security

Percentage of Americans who meet the criteria

For each income bracket

For a family of four, lower income is defined as a household income of $68,000 or less, median income between $68,000 and $203,000, and upper income of $203,000 or more.percentage meeting

Retirement criteria only reflects people age 35 and older. Young people did not have to meet retirement criteria to meet the full definition.

2022 Household Economics and Decision Making Survey

Most of the middle-income group lacks

middle class economic security

Percentage of Americans meeting each criterion

income group

Low income (less than $68,000)

Middle income group ($68,000 – $203,000)

Top income earners ($203,000 and above)

All incomes are adjusted to a household size of four people. The percentage meeting the retirement criteria only reflects people over the age of 35. Young people did not have to meet retirement criteria to meet the full definition.

2022 Household Economics and Decision Making Survey

Most middle-income earners lack the economic security of the middle class

Percentage of Americans who meet the criteria for each income group

Low income (less than $68,000)

Middle income group ($68,000 to $203,000)

Top income earners ($203,000 and above)

Pay $1,000 in emergency expenses

A comfortable retirement (35 years and older)

All incomes are adjusted to a household size of four people. The percentage meeting retirement criteria reflects only 35 people.

and older people. Young people did not have to meet retirement criteria to meet the full definition.

2022 Household Economics and Decision Making Survey

A Gallup poll last spring found that retirement is Americans' top financial worry. Even for those who can save, planning for retirement requires complex decisions about life expectancy and the future of government assistance such as Social Security and Medicare.

“The current de facto retirement landscape is saving desperately and hoping you don't live too long,” said Ben Harris, vice president and director of economic research at Brookings. “And that's a terrible paradigm.”

The shift from defined benefit plans to individual retirement accounts has increased the importance of saving for retirement, while also reducing mortgage and student loan payments, said Annamaria Lusardi, a senior fellow at the Stanford Research Institute. It is said that the proportion of income is increasing. In charge of economic policy research.

“There was a time when a family's income greatly determined their livelihood and financial security,” Lusardi says. “But now you're much more in charge of your future, especially in terms of the financial decisions that are being asked of people.”

Although the path to middle-class economic stability has become more complex, the proportion of people who have it has not declined significantly over time.

Since 2017, the first year of comparable data, between 32 and 40 percent of Americans have met all six indicators, with the lowest in 2017 and the highest in 2021.

Another survey, the Federal Reserve Consumer Finance Survey, provides a broader view of America's financial stability dating back to the 1980s. Adjusted for inflation, more Americans now have $1,000 in liquid savings than 40 years ago. And the percentage of Americans who have money in retirement or pension accounts has remained stable over the past 40 years.

“The idea that you can have a stable job with a predictable wage, health insurance and retirement benefits, and the ability to pay for housing is all part of a mid-century vision of a middle-class life trajectory.” he said. Anthropologist Zaloom.

“Even in the 1960s, the idea that this was a very widespread phenomenon was always kind of a fiction,” she added.

The appeal of the middle class is rooted in more than a desire for financial security.

“This is the perfect model of American identity,” said cultural historian Larry Samuel, author of “The American Middle Class: A Cultural History.” “It fits very well with our ethos of egalitarianism and meritocracy. These are all myths, of course, but they're built into how we see ourselves.”

“It's a club that everyone wants to be a part of, regardless of their financial situation,” Samuel said.

Sonia Vargas and Dylan Moriarty contributed to this report.

In this Washington Post poll, The survey was conducted Nov. 3-6, 2023 among a national sample of 1,280 U.S. adults, with a margin of error of plus or minus 3.7 percentage points. This sample was drawn through the SSRS opinion panel. This panel is an ongoing survey panel recruited from a random sample of U.S. households. To allow for subgroup comparisons, the study includes an oversample of low-income households. According to the U.S. Census Bureau, this and other groups are weighted based on their proportion of the adult population.

Definitions of low, moderate, and high household income are based on values from the Annual Socioeconomic Supplement to the 2023 Current Population Survey. All household incomes are scaled by an equivalent adjustment scale according to Pew Research Center standards. methodology.

The analysis of the financial security of American households uses data from the Federal Reserve's Survey of Household Economics and Decision Making (SHED) and Survey of Consumer Finances (SCF).

For each study, the middle class criteria were defined as follows:

- Stable job: Are in a non-temporary job or have already retired (SHED 2017-2022). Working people, retired people, people with disabilities, students, housewives (SCF).

- Covers emergency expenses: I was able to pay for a $1,000 emergency expense using only my savings (SHED 2022 for point-in-time analysis). Emergency expenses of $400/500 are paid using savings or credit cards that are paid back in full at the end of the month (SHED 2017-2022 for historical analysis). Had liquid assets (SCF) of at least $1,000.

- Pay the bills: I was able to pay all my bills in full during the study month, even if I had to pay an emergency expense of $400 or $500 (SHED 2017-2022) . It was free of debt service payments (SCF) last year.

- Health insurance: Had health insurance (SHED 2017-2022). Not applicable to SCF.

- Comfortable retirement: You feel like you're on track to save for retirement, or you're already retired and at least feel like you're in good shape financially. People under the age of 35 did not have to meet this criterion to be considered middle class (SHED 2017-2022). Any amount in a retirement savings or superannuation account (SCF).

- Save for future: Last month's expenses did not exceed your household income, or you have a rainy day fund to cover three months of expenses (SHED 2017-2022). Money saved (SCF) in the last 12 months.