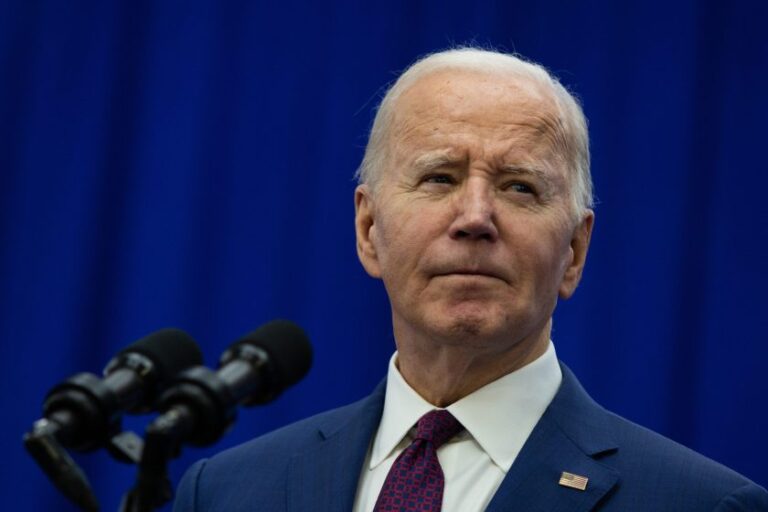

Joe Biden has unveiled plans to tax crypto mining in his 2025 budget proposal. Jason Bergman—Bloomberg/Getty Images

US President Joe Biden has proposed a range of crypto-related taxes and regulations that could generate nearly $10 billion next year and more than $42 billion over the next 10 years, according to his 2025 budget released on Monday. It states that there is. The proposals also include an excise tax on Bitcoin mining.

The proposal states that companies that use computing resources to mine digital assets would be subject to an excise tax equal to 30% of the cost of electricity used. The proposed tax would take effect from December 31, 2024, and would be introduced in three tiers: 10% in the first year, 20% in the second year and 30% in the third year.

“This budget proposal also closes loopholes that benefit wealthy crypto investors, as well as other tax loopholes that overwhelmingly benefit the wealthy and the largest and most profitable corporations. , saving billions of dollars,” the proposal continued.

Once implemented, miners would have to report the amount and type of electricity they use and how much they paid if purchased from outside sources. Meanwhile, as is common in so-called mining pools, miners that lease computing power must report the value of the power to the companies they lease. That value serves as the tax base.

The Biden administration is proposing to impose a 30% tax on electricity consumption. #bitcoin Even if you use your own solar or wind power and are off-grid. All of the reasons they give are false; the real reason is that they want to suppress Bitcoin and launch a CBDC. pic.twitter.com/juNHvO2NBx

— Pierre Roshard (@BitcoinPierre) March 12, 2024

Critics of the proposal include Republican Sen. Cynthia Lummis, who has voiced opposition to the tax proposal. on X. The inclusion of cryptocurrencies in the budget suggests that the administration may be bullish on cryptocurrencies, but a 30% tax would erode the presence of mining in the United States. she tweeted.

The White House's 2025 budget is incredibly bullish on cryptoassets, and some might even say they believe cryptoassets will go to the moon. 🚀

But a proposed 30% punitive tax on digital asset mining would destroy the foothold the industry has in the United States.

— Sen. Cynthia Lummis (@SenLummis) March 11, 2024

Bitcoin mining operations have been growing in the United States since the Chinese Communist Party banned miners from operating in China in May 2021. The industry is booming in Texas, especially because of the state's cheap electricity. Riding the tailwind of this bull market for Bitcoin, the stock prices of 11 publicly traded U.S. miners have soared over the past year, with CleanSpark ($CLSK) surging 270% in the past six months, according to data from CoinGecko. Rose.

Meanwhile, Dave Rodman, a cryptocurrency lawyer and founder of Rodman Law Group, also expressed dissatisfaction with the proposal.he said luck “I think it's really funny that in that statement, the oligarch's laundry list includes 'wealthy crypto investors'…The government has no control over the economic power that web3 will wield. It recognizes this, but focuses on suppressing it while exploiting it. ”

Biden's mining tax request came as part of his budget proposal, but the budget proposal remains an aspirational one, as any new revenue package would have to come from the U.S. House of Representatives, which is currently controlled by Republicans hostile to his policies. Many consider it to be part of a list or political statement. .

This is not the first time the Biden administration has sought to rein in mining operations. Biden proposed a similar tax in his 2024 budget last March, and recently pressured miners to disclose their electricity consumption in an emergency audit, but faced legal backlash. As a result, it was forced to withdraw last month.

The industry could account for 0.6% to 2.3% of total annual electricity use in the United States, according to initial estimates released by the Department of Energy last month. By comparison, consumption in Utah last year was about 0.8%, and in Washington state, which has a population of about 8 million people, it was 2.3%. In Texas, Bitcoin mining is already increasing the electricity bills of non-mining Texans by $1.8 billion, or 4.7%, a year, according to Wood Mackenzie.

Further proposals impacting cryptocurrencies include items related to the application of wash sale rules to digital assets, reporting requirements for financial institutions and digital asset brokers, and new foreign cryptocurrency account reporting rules that include cryptocurrencies in mark-to-market rules. is included.