K Bank, a South Korean neobank experiencing rapid growth thanks largely to its cryptocurrency business, plans to make an initial public offering (IPO) bid.

Anonymous financial industry sources said on March 10 that K Bank's board had approved the move.

Currently, Goal Bank is reportedly aiming to be listed on Korea's KOSPI stock market by the end of this year.

K Bank – Korean cryptocurrency success story?

According to news outlet Viva100, the company is counting on “expected gains” from the “recent increase in interest in Bitcoin” among South Korean retail investors who are keen on cryptocurrencies.

K Bank provides “real name” banking services (fiat on/off ramp) to Upbit, the country's largest cryptocurrency exchange.

The partnership was a huge success as K Bank was the only platform where new users could register for an account online during the coronavirus pandemic.

Since then, crypto accounts have been popular, with accounts linked to Upbit still accounting for the majority of the bank's revenue.

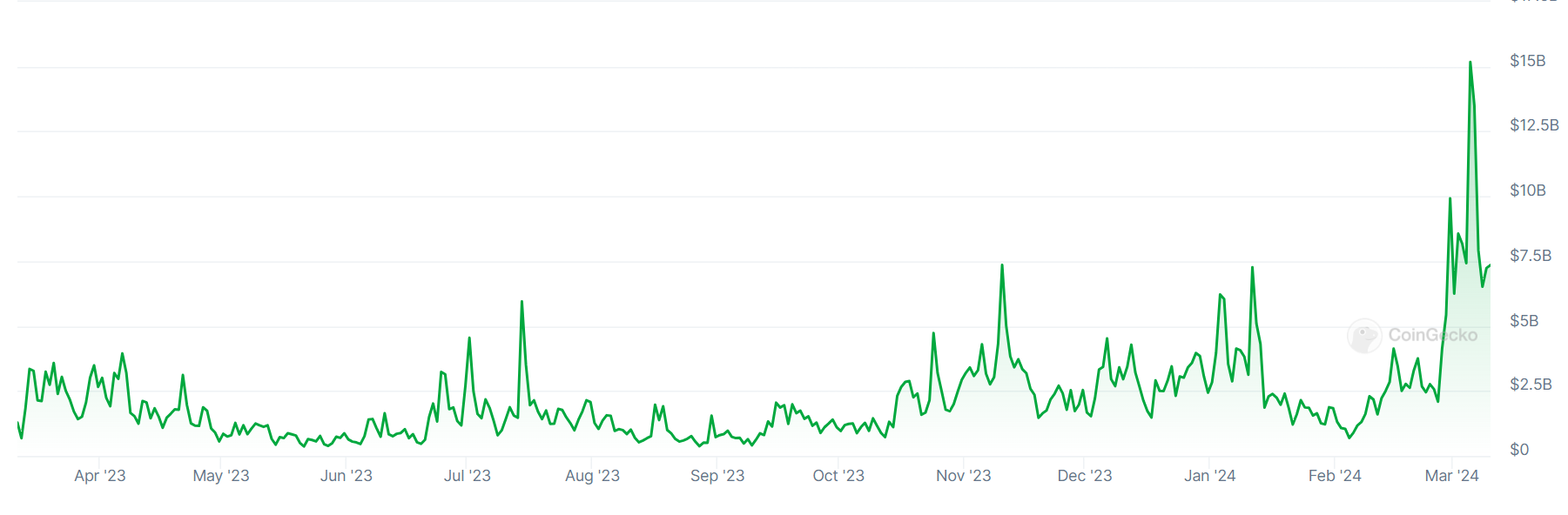

K Bank has seen a rapid increase in customer registrations during the previous BTC bull market. As Bitcoin continues to hit new all-time highs, the bank seems confident of further gains.

The media noted that new CEO Choi Woo-hyun, an expert in digital finance, was recently appointed to K Bank, fostering a “positive domestic and international environment for IPO preparations.”

Will more Korean crypto companies launch IPOs?

The media outlet claimed that the neobank contacted “major securities companies” earlier this year.

In February, it was reported that the bank had “selected NH Investment & Securities, KB Securities, and Bank of America (BofA) as preferred negotiating partners.”

The paper also claimed that the bank had formed a dedicated “IPO team” and started an “internal recruitment process.”

A previous bid to take the bank public in South Korea ended in disappointment. K Bank passed the preliminary exam for the KOSPI listing examination, aiming for an IPO bid in 2022.

However, the bank failed due to the stock market downturn in 2022. Due to the market downturn, the company was effectively forced to shelve the plan in February 2023.

Korean stocks are undervalued compared to many of their peers. The government is currently trying to correct the “Korean discount” by making corporate boards more accountable to shareholders https://t.co/HQphLNY7lh

— Bloomberg Markets (@markets) March 6, 2024

However, as the BTC price began to rise, K Bank exceeded the 10 million customer mark at the end of February 2024. The media wrote:

“The average number of new customers per day this year has grown more than three times faster than last year. The recent upward trend in Bitcoin is also a positive factor for K Bank. [IPO bid]”

In 2021, during the last BTC bull market, K Bank recorded $22.2 million in fee income from accounts linked to Upbit.

The Bank of Korea's policy committee is losing all of its early inflation-fighting measures, a former policy committee member said, adding to uncertainty over future efforts to curb price pressures https://t.co/ cWrDp7ngMg

— Bloomberg Markets (@markets) March 5, 2024

Late last year, Upbit's closest rival Bithumb announced plans to launch its own IPO bid. As retail investors are returning to the market and BTC prices continue to rise, trading platforms and their bids are likely to be energized.

At the height of the BTC bull market boom in 2021, Korean market analysts claimed that Upbit operator Dunam was planning to follow Kuhnbase into the New York Stock Exchange.