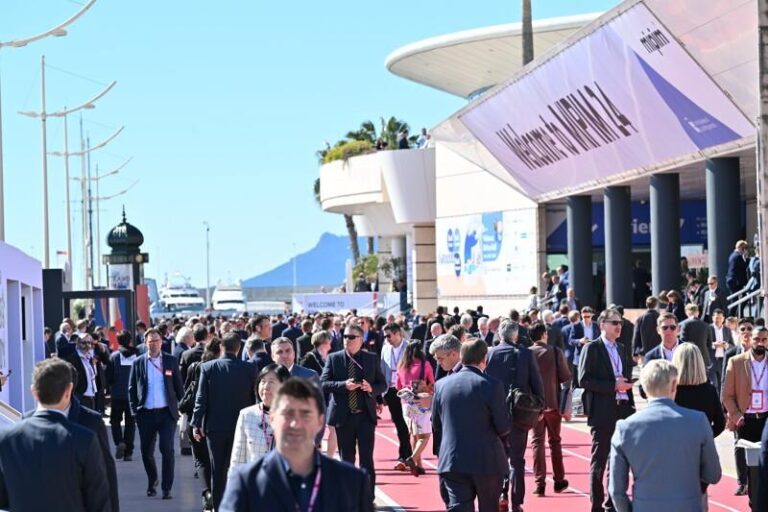

Last year, the atmosphere at MIPIM was tense. With the collapse of Silicon Valley Bank in the United States and what appears to be a new banking crisis spreading across Europe, a decision was made in haste to rescue Credit Suisse. A year later, sentiment at Cannes' annual real estate gathering is more positive, but still uncertain.

On Monday afternoon, more than 50 institutional investors, including pension funds, sovereign wealth funds and insurance companies, reunited for the annual private RE-Invest Summit (see box below for attending organizations). At a number of simultaneous roundtables, they were able to speak candidly about the issues that really bothered them, or the topic of “What keeps you up at night?”

The common expectation was that interest rates would start falling this year and trading activity would return to normal levels in the second half of the year. But will interest rates come down fast enough? And wasn't the same prediction made last year for trading activity?

Continuing concerns about valuation uncertainty, bank lending withdrawals, and the obsolescence of the office market coupled with the realization that investors will need to factor political risk into their real estate allocations more than ever before. there were. Inflation, the cost of living crisis, and rising housing prices in urban areas mean investors face increasingly unpredictable rental regulations. This comes at a time when many investors are looking to shift their portfolios from office and retail to the lifestyle sector.

But there was another recurring theme that was even more surprising. During the conversation, the word “infrastructure” came up one after another, which is not usually heard at MIPIM. With recent interest rate increases, real estate faces increased competition from fixed income, but it is also competing for capital with other alternative asset classes.

Both real estate and infrastructure have recently benefited from a decade of low interest rates, with institutional allocations to alternatives expanding as investors began to seek yield broadly. But while 2023 has been a difficult year for real estate in terms of repricing, revenue, transactions and financing, infrastructure does not appear to have been hit to the same extent. Infrastructure was a new asset class compared to real estate, but it has grown, become more mature and sophisticated during the long period of low levels. The consensus at Cannes was that the “newbies” had come of age.

On Wednesday morning, INREV held its annual MIPIM seminar, which sought to address the question of how attractive real estate is in this new phase. To provide a broader perspective on asset allocation, the European Real Estate Association invited Vera Fehling, her CIO for Western Europe and Head of Responsibility-Driven Investments at DWS. He was able to talk to his clients about the performance of various asset classes and how their pension funds were managed. It may be assigned in the future.

Fehring had good news. After a year of poor performance in 2023, DWS will start pumping capital into real estate this year, especially given DWS' core expectations that the European Central Bank and US Federal Reserve will start raising interest rates in June It is likely to be a “very good vintage year.'' This is the first of three interest rate cuts this year. However, in response to further audience questions, she went on to say that infrastructure is a “very hot topic” among investors, particularly in the energy transition space, and that many clients prefer infrastructure compared to real estate. He said the company's exposure is much lower, making it easier to allocate more funds. Capital to the former.

In a subsequent panel discussion, Anne Gales, co-founder and partner at Threadmark, which advises on capital raising for both asset classes, said infrastructure is growing rapidly. “We're definitely seeing a change right now,” she says. “I think this is a very interesting time to be talking about this.”

But more important changes may be on the horizon. On Tuesday, Konrad Finkenzeller, Head of Global Client Solutions at Patrizia, made an interesting prediction. He told IPE Real Assets that over the next four to five years, investors' allocations to real estate and infrastructure will consolidate, making it difficult to reconcile the overlap between the two.

Today, real estate and infrastructure investors and fund managers are increasingly looking to acquire similar assets. Examples include data centers, student housing, and medical facilities. However, although both investors are increasingly focused on the same assets, infrastructure fund managers may invest at different costs of capital due to their longer term and potentially lower return hurdles. This could create opportunities for real estate investors to sell certain real estate investments into these lower-cost sources of funding, Gales said.

One of the biggest reasons infrastructure seems to be gaining traction is that it now offers investors a way to directly participate in one of today's biggest investment themes: the energy transition . Funds targeting renewable energy, energy storage and other assets and technologies supporting the global transition to clean energy have raised billions of dollars from institutional investors.

Finkenzeller said infrastructure as an asset class now has a strong story to tell, and when pension fund CIOs consider allocations to alternatives, which have now grown to 30% of their portfolios, they are always persuaded. He said he was looking for strong investment stories.

Perhaps the real estate industry needs to step up its game and tell more of its own stories. During the INREV panel session, Finkenzeller's colleague Mahdi Mokhulane, head of investment strategy and research at Patrizia, said the industry needs to “better represent itself to allocators.” I doubted that.

Like infrastructure, real estate also plays a major role in decarbonizing the built environment. But equally important is its potential role in addressing the global housing crisis and its ability to positively impact society in tangible ways. “This is where we need to change our approach to real estate to respond to society's needs,” Mokrane said.

The comments come as Europe's largest pension fund, Dutch civil service ABP, plans to invest in 300 social impact investments by the end of the decade, including pledging 5 billion euros to build additional affordable housing in the Netherlands. The announcement comes a week after the company pledged to invest 100 million euros.

Affordable housing is severely undersupplied in cities around the world, but development is often constrained by planning systems, rising construction costs, and the respective financial requirements of investors, developers, and local authorities. It happens often. ABP's pledge, which includes social return targets as well as financial targets, could help break the impasse and set a blueprint for other institutional investors to follow.

Investors at the RE-Invest Summit were very keen to increase their exposure to the housing market, but found it difficult to invest, especially as regulations affecting the market became increasingly unpredictable. I did.

Greystar, a global specialist housing fund manager, has been expanding its European platform over the past decade. Mark Allnutt, executive director of the region's business, told IPE Real Assets that the chronic undersupply of rental housing, particularly in the student housing sector, meant that residential property fundamentals were undoubtedly strong. He said he meant it. Rising inflation and new regulations have posed challenges for the industry, but the situation is effectively “calming down”, he said.

Additionally, new innovations and practices in housing asset development are on the rise, such as modular homes that allow for low-cost, off-site construction. Allnutt said the rise of alternative intelligence (AI) technology will also accelerate innovation and trends in the housing sector. Greystar will look to see if AI can further leverage the growing pool of data it has on factors such as rental growth, demographics and yields across its portfolio, which serves more than 3 million customers every day doing.

AI is expected to disrupt all areas of the real estate industry, including the office sector. Andy Pyle, head of UK real estate at KPMG, told investors at the RE-Invest Summit that the effects of working from home and the differentiation and obsolescence unfolding in the office market could be accelerated and exacerbated by AI. He said it was expensive. This could help businesses scale back and utilize commercial space more efficiently.

The bifurcation of the office market is now well known and there are clear investment opportunities to provide top quality, state-of-the-art, sustainable commercial space in prime locations. James Bowdle, senior vice president at Oxford Properties, said the real estate investor would be looking for an opportunity to enter the sector after selling off office space in recent years. This is a well-timed move by the Canada Pension-owned business. Fund Omars.

The office sector has changed, requiring shorter lease terms and more customer-focused operational capabilities. Oxford Properties, which has made significant inroads into the life science real estate specialist space in recent years, will be well placed to navigate office investment opportunities should they arise, Bodle told IPE Real Asset. Ta.

But again, Finkenzeller is concerned about the impact technology and AI will have on the field. Sure, the best-quality stocks should perform well over the next five years, but the most interesting part will be after that, he suggested.

As leases get shorter and shorter and the pace of technological innovation quickens, will the cycle of obsolescence itself accelerate? How relevant will today's state-of-the-art buildings be in five years?

RE-Invest Summit: Investors in attendance

- Asia (United Arab Emirates)

- ADIC (United Arab Emirates)

- AIMCo (Canada)

- APG (Netherlands)

- Aware Super (Australia)

- BVK (Germany)

- Bowwinvest (Netherlands)

- CNP Assurance (France)

- CPP Investments (Canada)

- GIC (Singapore)

- Hoop (Canada)

- ICD (United Arab Emirates)

- Ivanhoe Cambridge (Canada)

- KIC (Korea)

- KLP (Norway)

- OIA (Oman)

- Ontario Teachers' Pension Plan (Canada)

- PFA Pension (Denmark)

- PGGM (Netherlands)

- PSP Investments (Canada)

- QIA (Qatar)

- Quadreal (Canada)

- Teacher Retirement System in Texas (USA)

- Temasek (Singapore)

- Zurich Insurance (Switzerland)