Opponents of the so-called “Bring Chicago Home” real estate transfer tax referendum filed an appeal with the Illinois Supreme Court on Monday, putting the fate of the referendum once again in the hands of the judges.

Lawyers for the Chicago Building Owners and Managers Association repeated their argument in their appeal that the referendum illegally forced voters to approve or reject three separate policies with one question. The referendum question includes tax reductions and two tax increases on real estate transfers of three different values.

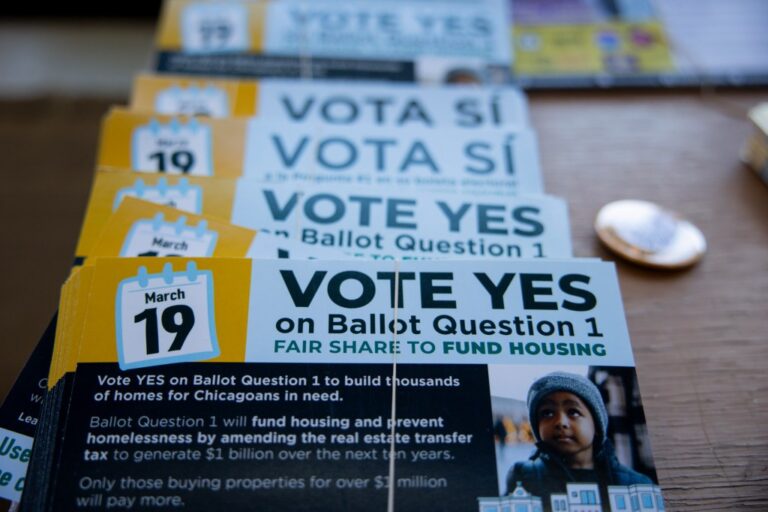

The filing marks a new development in the legal battle over a referendum that would raise transfer taxes on property values over $1 million to raise an estimated $100 million in revenue that supporters say will go toward homelessness efforts. .

Cook County Judge Kathleen Burke ruled in late February on the original lawsuit brought by BOMA Chicago, invalidating the referendum. The ruling meant that votes related to the referendum would not be counted, even if the issue remained on the ballot.

But last Wednesday, a state appellate court overturned that decision. The decision clears the way for the Chicago Board of Elections to decide the outcome of the referendum after the March 19 primary.

A BOMA Chicago spokesperson said a final decision on the future of voting could be made before the primary.

“The referendum question is misleading and manipulative, and we believe it is important to see this through,” Farzin Paran, executive director of BOMA Chicago, said in a statement.

The Bring Chicago Home coalition, which supports the referendum, criticized the appeal Monday afternoon. In her statement, Maxika Williams, chair of the End Homeless Ballot Initiative Committee, accused the developer of throwing up “obstacles to the democratic process.”

“The real estate lobby continues its efforts to silence voters in the Chicago referendum to address the housing crisis they created and benefited from, while 68,000 people were stabilized. They are homeless,” Williams said.

The Illinois Supreme Court is expected to act quickly on the appeal and could decide whether to take up the case as early as Tuesday, according to the Chicago Board of Elections, which is named as a defendant in the appeal. Spokesman Max Biver said.

A spokesperson for Mayor Brandon Johnson, who strongly supports pushing the referendum on the primary ballot, did not immediately respond to a request for comment Monday afternoon.

If voters approve the referendum, the Chicago City Council will formally vote to change the city's current flat 0.75% tax on real estate sales prices. Interest rates on properties purchased for less than $1 million will be reduced to 0.6%. Properties purchased for between $1 million and $1.5 million are subject to a 0.6% tax on the first $999,999 of the sales price and 2% on the remainder. For sales over $1.5 million, the company will pay 0.6% on the first $999,999, 2% on the next $500,000, and 3% on the remaining sales.