With its fourth startup, Pulley, Yin Wu is attacking the cap table management software niche currently dominated by scandal-scarred Carta.

by hank tuckerForbes staff

upon Sunday, January 7th Mr. Yin Wu's inbox continued to receive emails from potential clients asking about the company's product, also known as Cap Table, which helps startups track ownership of their company's stock. At first she was confused. “Normally on a Sunday night, nobody's thinking about their cap table,” Wu, 35, said.

But the roots of that interest soon became clear. A LinkedIn post by Kari Saarinen, CEO of software project management startup Linear, was distributed without consent by Carta, the clear category leader in corporate capital table management. They accused him of buying Linear shares on the market. As the controversy spread across Silicon Valley, Saarinen and Carta CEO Henry Ward got into a spat on X (formerly Twitter) over the weekend, with Ward blaming rogue employees and Saarinen criticizing other founders as well. Claimed to be experiencing the same issue. Finally, on Monday, Mr. Ward made a major public announcement on Medium, announcing that Carta would cease its secondary private equity trading operations in order to restore trust. By then, many of the company's 40,000 customers were already wondering about alternatives.

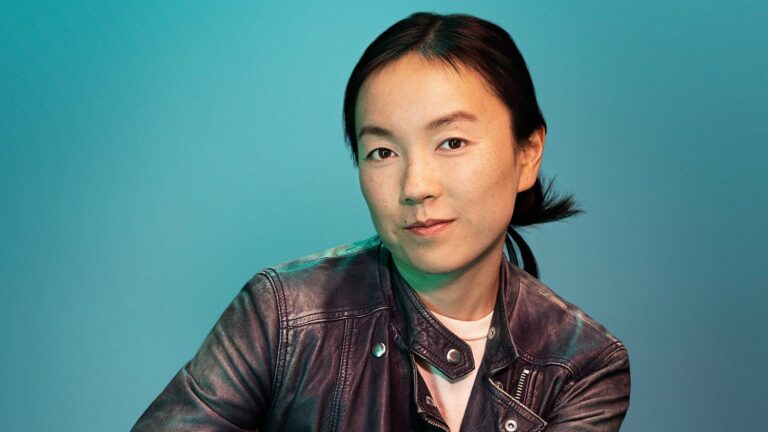

Photo by Cody Pickens for Forbes

San Francisco-based Pulley is the most visible challenger to Carta and a newcomer to this year's FinTech 50 list. Co-founder and CEO Wu quickly entered the fray, offering a discount on Pulley's fees to cover the cost of existing cap table agreements if founders switch to Pulley by the end of January. I promised X that I wouldn't have to pay. At the same time he deals with two vendors. Demo requests have increased eight times compared to the previous month, and approximately 400 new customers have signed up, bringing Pulley's customer count to 4,600, more than double his 2,200 at the beginning of 2023. Ta.

It was a fortunate and well-timed break for serial entrepreneur Wu. Mr. Wu is not at all intimidated by the fact that he entered the cap table game seven years after market leader Mr. Carta. She's gambling, but she doesn't necessarily need to be in first place to win in the long run.

“When Stripe started, it wasn't the first payment processor. Braintree, Amazon Pay, and Paypal all existed,” Wu says. “But when you talk to people who actually use any of these payment networks, it's not like they're having all that great of an experience with these platforms. Rather, it's like, well, this is It felt like it was a species.”

For now, Puri still lives in Karuta's long shadow. Carta has 40,000 customers and was valued at $7.4 billion in its last funding in August 2021. Carta declined to comment. forbesbut Analysis regarding X Market research firm CB Insights found that 89% of customers surveyed still intend to renew their plan.

Pooley has received $50 million in funding from Stripe, Founders Fund, and angel investors including Elad Gill, Jack Altman, and Wu's husband Avichal Garg, and closed for a Series B in October 2022. The round valued the company at $250 million.

But Wu says Pooley's funding modeling technology is superior, allowing founders to see how much their equity will be diluted by complex early-stage funding structures, and how much their equity will be diluted by complex early-stage funding structures, as well as pro-rata and “most-favored-nation” shares. They argue that this will help them understand exactly what control they are giving up if they offer to transfer their assets. ” status attracts early investors. She also highlighted Pulley's offer letter tool, which seamlessly tracks equity grants to new hires on the cap table and facilitates the logistics of board approval of offers and submission of option grants.

Pulley charges customers $1,200 a year for its lowest price point, which allows you to track up to 25 parties. The $3,500 annual growth tier includes up to 40 stakeholders and an annual 409A valuation (fair market valuation required for tax purposes). Many customers opt for custom pricing plans for more advanced features. Pulley expects its revenue to triple this year and bring in tens of millions of dollars in 2024.

“For us to win in the market, it's important that we have the customer obsession and service that Bezos always talked about at Amazon,” said co-founder Marc Erdman. He is a software engineer remotely based in Calgary and mentoring Pulley engineers. “These founders are providing us with valuable capital and are willing to use every dollar to help their startups succeed.”

if

everyone knows Struggling to get his startup off the ground is Wu, who started three companies before arriving at Pulley. The Louisville, Kentucky native first became interested in computer science during her high school days, coding to help with projects at science fairs. She was a finalist in her Intel Science Talent Search, which recognizes a select group of high school seniors across the country, and was planning on attending medical school for her. Instead, she quickly realized her talent as an entrepreneur at Stanford University, where she majored in computer science and became co-president of the Stanford Entrepreneurship Association during her senior year. Ta.

As part of that role, she helped organize YCombinator's “Startup School,” with Jessica Livingston and Paul, one of the co-founders of the prestigious startup accelerator that seeds hundreds of companies twice a year. I developed a relationship with Mr. and Mrs. Graham. She was run by OpenAI CEO Sam Altman from 2014 until 2019). She was one semester short of graduating with a science degree, but she didn't have a clear idea of what she wanted to do, so Ms. Wu turned to Mr. Livingston for advice. Ta. “She said, 'Why go into consulting or something like that when you can start a company?'” Wu recalls.

Wu dropped out of Stanford University when he was accepted into the 2011 batch of YCombinator for his first company, AdRaid. AdRaid has developed technology that makes it easy for creators to overlay ads onto videos or slap logos onto surfaces to aid post-production product placement. It was a hit with his YCombinator, where he raised $1 million a week after the demo, but failed to gain traction from advertisers or content creators. Within a year, Wu closed it down.

In 2013, she and co-founder Xu Wencao piggybacked on budding startups in other industries, including DoorDash and the former on-demand house cleaning and handyman company Homejoy. So, I tried Prim, a same-day laundry delivery service, again. Mr. Wu frequently picked up and delivered laundry himself. “I've gotten really good at folding T-shirts, especially,” she says. But the market for upper-class Bay Area people paying too much to do their laundry instead of doing it themselves eventually became too small, and competition from mom-and-pop laundromats became too intense. Mr. Wu and Mr. Cao dismantled Prim's operations and sold some of the technology that controlled delivery to a small private equity firm.

“We want to get all the new startups, and we also want a lot of the existing companies to switch to Pulley.”

Wu and Cao then pivoted to Echo, a customizable smart lock screen for Android smartphone users. Echo effectively acts as a prioritized inbox for notifications, ensuring important updates aren't buried behind irrelevant updates for other apps. Third time's the charm, and the app has garnered over 5 million downloads. They sold his Echo to Microsoft for an undisclosed amount in 2015, and it still exists today as Microsoft Launcher. The sale was “not life-changing, but it was more money than I've ever made in my entire life,” Wu said in a speech at the 2022 YC Startup School.

“When you first start a company, a small exit is often OK,” said Elad Gil, a tech investor who has known Wu since he ran Echo and invested in Pulley. says. “Then they feel a little safer, have less impostor syndrome, know the basics of starting a company, so they go for something bigger next time. On average, second- or third-time founders are doing much better than first-time founders.”

Wu continued working at Microsoft for two years, but instead of climbing the career ladder right away, he was thinking about his next project. In Seattle, she reconnected with Aardman, where she had worked as a university intern and engineer at machine learning company Cloudflower. The two founded Pulley in 2019 after a brief attempt at a blockchain project for decentralized information curation that failed during the crypto bear market of 2018 and 2019. It was seven years after Carta got a head start.

For Wu, it was the culmination of lessons learned over nearly a decade. In her first try at an advertising startup, she says, she could understand the technology, but she couldn't understand the customer. In her twenties, troubled by the inconvenience of living in an apartment without a washing machine, she realized that she didn't feel passionate enough to dedicate her life to laundry, so she turned to a more sympathetic pursuit. I was guided. She returned to her love of software with her Echo, and this time she wanted to serve the customers she felt she understood better than anyone else: other founders. She named it Pulley to evoke a “simple machine” that would alleviate the enormous work of setting up a company.

“It comes down to who you want to help. Who do you want to spend all your time with? Because there's no guarantee of success for any startup you work on,” says Wu. . “It's a great day because I get energy from the people I'm helping and working with. For me, it goes back to the founders.”

in In 2020, Wu went Third time through YCombinator, this time using Pulley. She did it, she says now, more to make connections with other founders than to attract capital for herself. done. She has the majority of YCombinator classes signed on to the platform, and Pulley says she has more than 70% market share among her recent YCombinator graduates.

“I think no matter which company ends up beating out the YC companies, it will end up being the platform that wins overall,” Wu said. “The founder community is very tight-knit and you hear about it from other companies and they get involved.”

Although Pulley has an edge among this particular demographic of Silicon Valley startups, it still has a long way to go before becoming a dominant force nationally, with Carta managing not only Carta but also 2,500 cap tables himself. Faces competition from peers like AngelList. Pulley implemented features last year, including tools to help customers comply with stock-based compensation reporting requirements, and is working to expand its product suite beyond its core cap table product. Last year, it also started tracking blockchain startups’ token distribution.

“We want to get all the startups, and we also want a lot of the incumbents to switch to Pulley,” Wu says. “If you create a product that is 10 times better, the market is often bigger than most people believe.”

More from Forbes