Venture capitalists (VCs) are reportedly sitting on $311 billion in unspent cash as technology funding cools.

U.S. venture capital groups raised a record $435 billion from investors between 2020 and 2022, but only utilized half of it, the Financial Times (FT) says, according to PitchBook data. It was reported on Tuesday (January 30th), citing.

This means large amounts of “dry powder” (industry slang for unspent cash) are accumulating as VC firms become cautious about investing as startup valuations fall. Rather, these companies are focusing on more established companies or strengthening their existing portfolios, the report said.

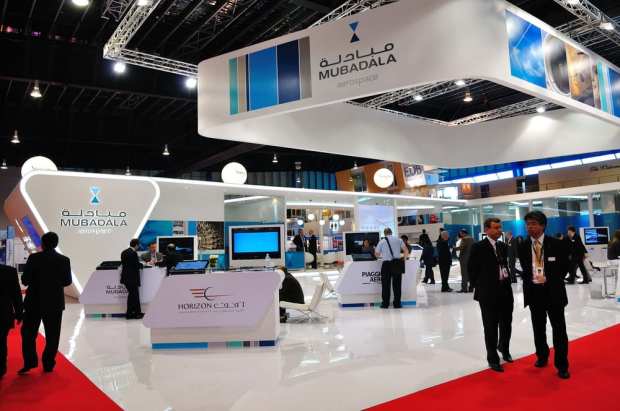

Ibrahim Ajami, head of venture at Mubadala Capital, part of the $276 billion Abu Dhabi sovereign wealth fund Mubadala Investment Company, said: “There is certainly dry powder, but the world is not seeing VC money again.'' It's not like it's going to flood,” he said.

And as that flood of capital dries up, startup bankruptcies are doubling, says the FT. Companies like Hopin and convoy Last year it was lower.

“In a sense, dry powder is a mirage. It's a theoretical number.” Nigel DornGlobal Head of Private Capital Advisory at an Investment Bank evercorehe told the press.

“Venture fund portfolio companies are feeling more cash-strapped than ever, driven by the idea that they just need to grow. grow without making a profit Gone is the always-on cash slot right in front of you. ”

As mentioned here earlier this month, V.C. Raise $67 billion in 2023Analysts at PitchBook predict that venture capital funding may rise this year, but likely won't reach pandemic-era highs.

“Everything is trying to find a balance,” Kyle Stanford, a venture capital analyst at PitchBook, recently told Bloomberg News.

PYMNTS explored the changing funding landscape in an interview earlier this month. Mahdi Razaco-founder and co-managing partner of Exponent Founders Capital.

He told PYMNTS CEO Karen Webster: Founder's profile The landscape has changed, with startups now being run by more experienced management teams, as opposed to the pandemic era, when companies could raise $100 million with no product, no customers, and just the specter of a business model. It's coming.

“The founders are now customer-centric, product-centric and saying, 'This is going to be my life's work and journey for the next 20 years,'” Raza said.