Warren Buffett has long been vocal about his distaste for Bitcoin. “When it comes to cryptocurrencies, I would say that, in general, it's almost guaranteed to end badly,” he said in 2018. At the time, the price of Bitcoin was around $15,000.

Currently, the value of Bitcoin has soared to over $50,000. Still, Buffett hasn't changed his mind. Even if someone offered him all the Bitcoin in the world for $25, Buffett wouldn't take it, he said. “So what are you going to do about it?” he asked. “I have to sell it back to you somehow. That doesn't do any good.”

There are exceptions to every rule. Buffett doesn't like Bitcoin, but that doesn't mean his holding company. berkshire hathaway (NYSE: BRK.A)(NYSE: BRK.B),I hate.

Berkshire's market capitalization now stands at nearly $900 billion, and Buffett has a number of experienced advisors helping him manage his vast portfolio. He or one of his advisors seems to like one stock so much that he bets $1 billion on it. The stock is highly exposed to the rise in cryptocurrencies, including Bitcoin.

Riding the Bitcoin wave

There's an old adage about gold rushes. “Don't chase the gold, sell the pickaxe. Whether gold is discovered or not, you will always make money.” That's the strategy. New Holdings (New York Stock Exchange: NU) When it comes to profiting from cryptocurrencies, here's what it looks like:

In 2013, Nu took the Latin American banking industry by storm under the name Nubank. The pitch was simple. For too long, the region's banking industry has been dominated by a few powerful companies that use their market power to charge customers high fees for simple services.

Born as a digital-first bank, Nubank began offering low-cost financial products such as bank accounts, credit cards, and personal loans to anyone with a smartphone or computer.

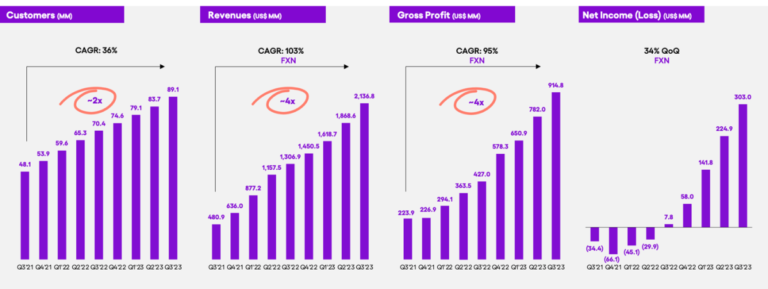

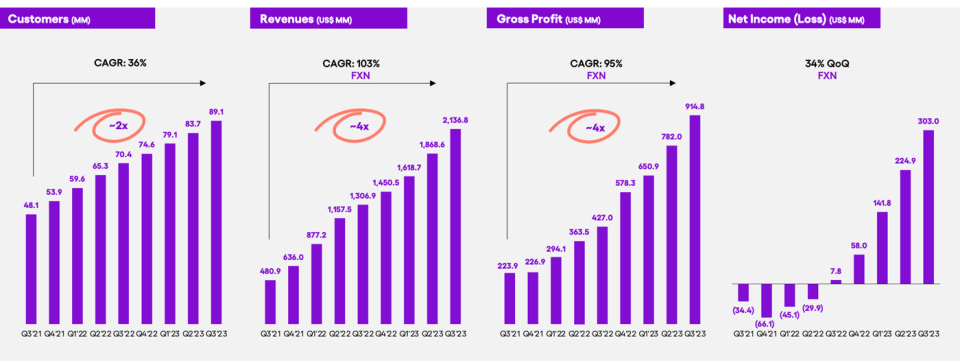

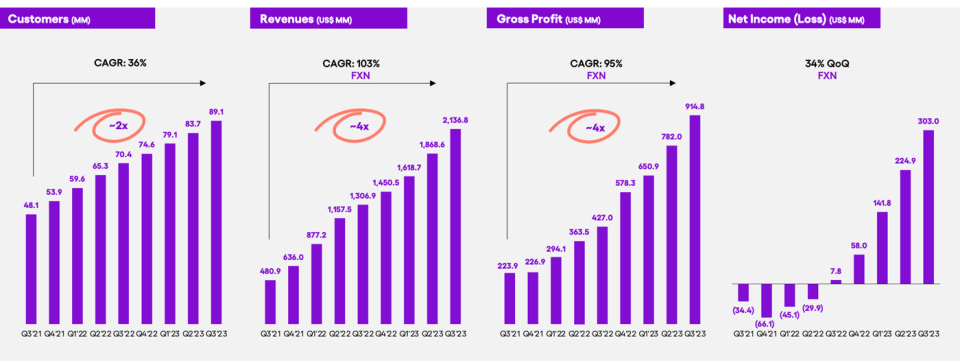

Latin America's appetite for low-cost, easy-to-use financial products has proven overwhelming. For example, in 2014, the bank had few customers. Since then, that number has increased every quarter, reaching more than 90 million people in 2023. Amazingly, more than half of Brazil's adult population are now Nubank customers.

Nubank has done a great job of adding new financial products as their customer base grows. By doing so, the company can benefit not only from an increase in the number of customers, but also from an increase in the number of products that customers use.

When Nubank launched, the average customer used only one of the company's products. It was the only product banks were offering at the time. Currently, new customers start with an average of three financial products, and this number only increases the longer they stay with Nubank.

One of those new products is Nucripto, introduced in 2022. This will allow Nubank users to buy, sell, and trade over a dozen cryptocurrencies. Bitcoin and Ethereum It contains. Nucripto gained over 1 million active users in its first month of operation.

Nubank is in the early stages of cryptocurrency growth. We are rolling out our own digital currency, Nucoin, and continue to add new cryptos to our platform, including: Polka dot pattern and avalanche .

The company still makes the majority of its revenue from other financial products such as credit cards, insurance policies, and traditional investment accounts. However, with over 1 million active users and a platform that is strengthened every quarter, it has a leading position in the Latin American cryptocurrency market.

Classic Buffett stocks?

Buffett has avoided technology stocks for decades, but he has a long relationship with banks.Berkshire Hathaway owns shares american bank and citygroupFor example, it owned wells fargo Stocked for years.

In many ways, NuBank is a classic Buffett stock. The company was founded by David Velez, a former venture capitalist with experience at Sequoia Capital. In addition to experienced founders, Nubank also has a strong economic moat. It will be difficult for competitors to replicate the company's business model.

That's because Nubank started from a digital-first position. Meanwhile, other industries are largely tied to high-cost business models that require large staff and expensive physical branches.

Nubank can only act faster and more efficiently than its competitors, and this advantage is not going away anytime soon. The cryptocurrency aspect is just one of the company's growth drivers, but it's exactly that. Nubank offers many high-demand financial products to a growing customer base, and despite its rapid growth in recent years, the company remains largely untapped in its potential addressable market.

Stocks aren't cheap given the strong stock rally in 2023, but investors like Buffett invest early in stocks with the potential for consistent growth for decades to come. I know that it is beneficial.

Should you invest $1,000 in Nu now?

Before purchasing Nu stock, consider the following:

of Motley Fool Stock Advisor Our analyst team has identified what they believe Best 10 stocks Investors can buy now…and Nu was not one of them. These 10 stocks have the potential to generate impressive returns over the next few years.

stock advisor We provide investors with an easy-to-understand blueprint for success, including guidance on portfolio construction, regular updates from analysts, and two new stocks every month.of stock advisor Since 2002, the service has more than tripled S&P 500 returns*.

See 10 stocks

*Stock Advisor will return as of February 20, 2024

Citigroup is an advertising partner of The Motley Fool's Ascent. Bank of America is an advertising partner of The Motley Fool's Ascent. Wells Fargo is an advertising partner of The Motley Fool's Ascent. Ryan Vanzo has positions in Bitcoin and Ethereum. The Motley Fool has positions in and recommends Avalanche, Bank of America, Berkshire Hathaway, Bitcoin, and Ethereum. The Motley Fool recommends Nu. The Motley Fool has a disclosure policy.

Warren Buffett doesn't own Bitcoin, but his company is betting $1 billion on the cryptocurrency stock The original article was published by The Motley Fool