The technology industry is hot and full of surprises, but there are some overlooked companies like Dell (New York Stock Exchange: Dell) It began to draw a parabola as if in an instant. There is no doubt that AI technology will benefit, and it's not just the “Magnificent Seven” stocks. In 2024, we may see the AI wave lifting other boats sailing on the rough waters of technology. So let's use TipRanks' comparison tool to analyze his three tech stocks (DELL, CDNS, INTU) that have the potential to turn AI innovation into meaningful stock price drivers over the next year.

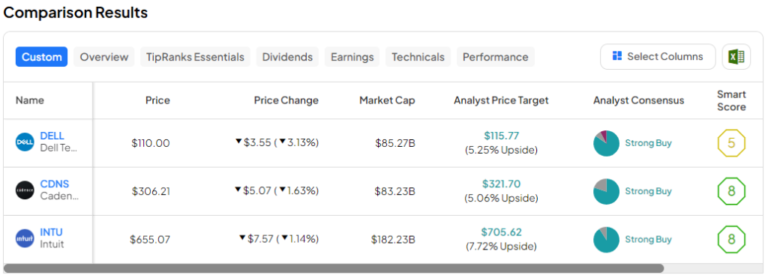

Analysts currently view each stock fairly favorably, despite last year's torrid performance.

Dell Technologies (NYSE:DELL)

Dell was a big winner when it released its latest quarterly results, with its stock soaring about 30% in one day. High demand for AI servers was a big reason why Dell was able to pole vault above expectations in terms of revenue. Combined with a 20% dividend increase and upbeat (and AI-heavy) guidance for fiscal year 2025, it seems like many investors are starting to realize the company has AI potential.

I'll admit that DELL stock is one of the names I've removed from my tech watch list in favor of bigger, more prominent players in the AI scene. DELL stock has more than tripled (up 210%) over the past year, but at a price-to-earnings ratio of 25.0x and forward P/E ratio of 15.6x, it's not particularly expensive. Considering the size of the AI tailwind. For these reasons, I, like the analyst community, tend to remain bullish on his DELL.

With exciting emerging terms like edge AI, AI PCs, and neural processing units (NPUs) set to become popular in 2024, Dell Technologies stock could be one of the next companies to grab the attention of investors on the upside. There is a possibility that With its AI-enabled Precision 3000 and 5000 workstations, Dell stands out as one of the potential key beneficiaries as AI begins to move from the cloud to the edge.

What is the target price for DELL stock?

According to analysts, Dell's stock is a strong buy, with 11 buys, 1 hold, and 1 sell in the past three months. DELL's average price target of $115.77 implies an upside potential of 5.3%.

Cadence Design Systems (NASDAQ:CDNS)

Cadence Design Systems' stock price is much higher than Dell's, with the stock currently trading at a P/E ratio of 81.5. In terms of sales to sales (P/S), the stock looks even more expensive at 20.4x his P/S. In fact, CDNS stock commands a significant premium to the Application Software industry average. But Cadence is a state-of-the-art intelligence systems design business that is truly on a level of its own.

The company's Millenium M1 AI supercomputer system has the potential to change engineering design and complex simulation as we know it. Given how deep the AI-powered technology is, I would argue that CDNS stock is worth its seemingly expensive multiple. When Cadence picks up the AI ball and runs with it, it proves difficult to be anything but bullish as the company looks to bounce back from a rare quarter of slight weakness.

Last month, Morgan Stanley (New York Stock Exchange:MS) has been increasingly vocal about Cadence's long-term strategy, believing it's worth getting behind after the company's recent first-quarter failure. Morgan Stanley analyst Lee Simpson expects “chip design momentum” to continue “at least into next year.” The bank also raised its price target on CDNS stock from $260 to a street high of $350.

What is the target price for CDNS stock?

CDNS stock is a “strong buy” according to analysts, with eight buy and two hold assignments over the past three months. CDNS's average price target of $321.70 suggests a potential upside of 5.1%.

Intuit (NASDAQ:INTU)

Intuit stock has rebounded significantly over the past year and is now up more than 83% from its lows in late 2022. Top tax preparation software companies are sure to gain even more attention as tax season approaches. But while new innovations in the field of AI are being introduced, it's the company's services for small businesses and the self-employed that will be the star of the show.

As Intuit invests in AI, its economic moat will widen further and its valuation multiple could continue to balloon. I remain bullish on this stock as the stock continues to hit new all-time highs.

The company's most recent quarter was a pretty strong 11.3% year-over-year increase in sales to $3.39 billion. QuickBooks helped his Intuit strengthen the beat, while Credit Karma held back slightly. Going forward, Intuit Assist, much like his AI co-pilot in the company's suite of software, will look to make further leaps forward in the year ahead.

Combined with Intuit's Generative AI Operating System (GenOS), it's clear that the Intuit ecosystem will only get stronger in the future. I believe Intuit is an AI stock masquerading as a financial software company as it seeks to achieve its goal of evolving into an “AI-driven expert platform.”

What is the target price for INTU stock?

Cadence stock is a “strong buy” according to analysts, with 20 buy and 2 hold assignments over the past three months. INTU's average price target of $705.62 implies an upside potential of 7.7%.

conclusion

In 2024, we'll see that it's not just the big tech stars who will benefit from the AI revolution. The following three of his companies stand out as companies that can use AI to extend their advantage in their respective markets of interest. Of the three, Del is the one I'm most excited about. It has established a solid position in AI PCs with a reasonable multiplier. But for now, analysts see INTU stock as having the most upside.

disclosure