onurdongel/E+ via Getty Images

By Michael Sobolik, Managing Director, Regional Investment Strategist, North America, Invesco Real Estate

Is owning a home your only investment in real estate? Institutional investors have long understood the merits of real estate, typically devoting 8% to 10% of their portfolio to real estate1 compared to 3% or less for most individual investors.2 Including an allocation to real estate in a portfolio with only equities and bonds has potential benefits. Here are some to consider.

Competitive long-term return potential: Total and risk-adjusted

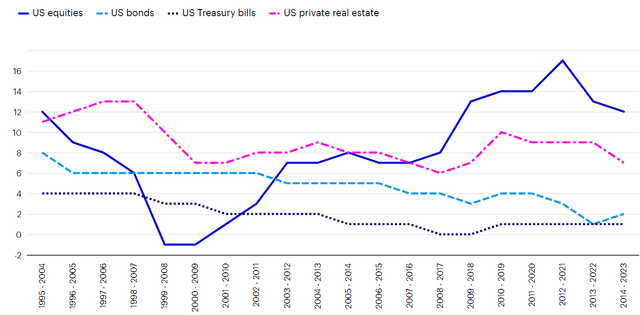

US private real estate has provided competitive total returns compared to the return on US equities and bonds and Treasury yields over a long-term period. For the past 20 successive 10-year rolling periods of quarterly annualized returns going back to the mid-1990s, total returns for US private real estate, measured by the unlevered NCREIF Property Index (NPI), were the highest or next-highest compared to returns for US equities, US bonds, and the average yield of the 3-month US Treasury bill. (See chart below.)

US private real estate has delivered competitive long-term total return potential

Rolling 10-year average annual returns for major US asset classes (%)

Source: Invesco real estate with data sourced from Bloomberg L.P. and NCREIF. Based on quarterly annualized returns. Full period of returns shown begins January 1, 1995 and ends December 31, 2023. US equities represented by the S&P 500 Index. US bonds represented by the Bloomberg US Aggregate Bond Index. US real estate represented by the Classic NCREIF Property Index (from here on referred to as “NPI”). Treasury bills represented by the 3-month US Government Treasury. An investment cannot be made directly in an index. Past performance is not indicative of future results.

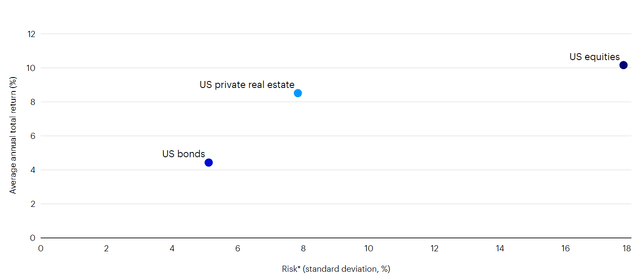

Over the past 30 years, the risk-adjusted return for US private real estate (1.1 for the NPI Index) has exceeded the risk-adjusted return for the S&P 500 Index (0.57) and the Bloomberg US Aggregate Bond Index (0.86).3 That’s because US private real estate’s historical total returns are closer to US equities than US bonds but the volatility of its returns (i.e., the standard deviation of annual total returns over time) is closer to US bonds than to US equities.

US private real estate has provided higher returns than US bonds and lower volatility than US equities

Return-risk profile, January 1, 1994 to December 31, 2023 (30-year period)

Source: Invesco real estate with data sourced from Bloomberg L.P. from January 1, 1994 to December 31, 2023. US private real estate represented by NPI; US equities represented by S&P 500 Index; US bonds represented by Bloomberg US Aggregate Bond Index. NCREIF appraisal lags are known to play a role in understating historical return volatility and overstating historical risk-adjusted returns when standard deviations (SDS) are calculated from quarterly returns and then annualized, which is the conventional approach. To account for this bias, SDs were calculated for each asset class using rolling annual returns instead of annualizing the quarterly SDs. For US private real estate returns, this method produced much higher SDs (7.84%) compared to the annualized SD method based on quarterly returns (4.46%). Results between the two methods were closer to each other for the other two asset classes. Results for the S&P 500 Index: 17.76% based on SD of annual returns versus 16.47% based on annualized SD of quarterly returns. Results for the Bloomberg US Aggregate Bond Index: 5.12% based on SD of annual returns versus 4.35% based on annualized SD of quarterly returns.

Diversification

One way to measure the diversification potential of an investment is to look at correlation. Over the past 30 years, US private real estate has had a low correlation to US equity (0.08) and US bonds (-0.12), which means it has provided greater portfolio diversification.4

Private markets exposure

As the third largest US asset class after equities ($51 trillion at year-end 2023) and bonds ($59 trillion), private real estate ($18 trillion) is the largest among private markets alternative asset classes.5

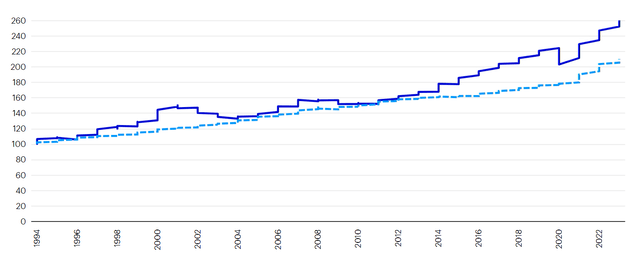

Inflation hedge

Inflation can erode the purchasing power of income from stock dividends or fixed income. But the income generated by private real estate is different – it’s tied to rents, which generally rise when inflation goes up. Real estate income growth has kept pace with inflation over long-term periods.

US private real estate income has kept pace with inflation

Indexed US property income versus US inflation (100 = January 1994)

Sources: NCREIF, Bureau of Labor Statistics, Moody’s Analytics, as of Mar. 2024. Indexed property income is based on quarterly growth of net operating income (NOI) from the NCREIF Property Index across the apartment, industrial, mall, office, and retail property types. NOI equals all revenue from a property minus all reasonably necessary operating expenses. The Consumer Price Index (CPI) is a measure of the average change over time in the prices paid by urban consumers for a representative basket of goods and services.

Durable income potential

In a market environment of low yields and economic uncertainty, investing in US private real estate may provide durable income potential. Over the past 20 years, average income returns have been stronger in US private real estate (5.35%) than in US bonds (3.24%) or US equities (1.96%).6

Tax advantages

Investing in US private real estate may provide tax benefits for investors.7 For example, real estate investment trusts (REITs) can pay three types of distributions: ordinary income, capital gains, or return of capital (ROC).8 Each is taxed at a different rate. Ordinary income is taxed at an investor’s marginal income tax rate. Capital gains are taxed at either 15% or 20%, depending on the investor’s tax bracket. ROC distributions are tax deferred until the investor sells their REIT shares. For estate planning purposes, an inheritor of a REIT receives a step up in cost basis to fair market value.9

The track record of US private real estate provides compelling reasons for investors to consider including an allocation to private real estate in a portfolio with only US equities and bonds. Of course, real estate investing, as with all investing, isn’t risk-free. And past performance isn’t a guarantee of future results.

Footnotes

-

Source: 2023 Institutional Real Estate Allocations Monitor, Hodes Weill and Associates, Cornell University (Cornell Baker Program in Real Estate), Nov. 2023. There are material differences in the investment goals, liquidity needs, and investment horizons of individual and institutional investors. Investors should consult with a financial professional regarding their own situation and risk tolerance before making any investment decisions. Retail investors may already have significant exposure to the real estate asset class through home ownership.

-

Source: Estimate based on Global Private Equity Report 2023, Bain & Company. Ultra-high-net-worth individuals and family offices (net worth of $30M+) are estimated to have alternatives allocations of nearly 20%, whereas all other categories of individual investors are estimated to have alternatives allocations ranging from 0% to 3%. Real estate is the largest investment class within the alternatives category.

- Risk-adjusted return is calculated by dividing the total return by the standard deviation of return during the specified time period. Standard deviation is a statistic that measures the dispersion of a dataset relative to its mean.

-

Sources: Invesco Real Estate using real estate data from NCREIF (NPI) and Bloomberg L.P. (S&P 500 Index for US equity; Bloomberg US Aggregate Bond Index for US bonds). Correlations were calculated from Jan. 1, 1994 to Dec. 31, 2023. You cannot invest directly in an index. Correlation indicates the degree to which two investments have historically moved in the same direction and magnitude. Diversification does not guarantee a profit or eliminate the risk of loss.

-

Sources: Invesco Real Estate, utilizing data from CoStar, Yardi Matrix, National Association of Realtors, US Census Bureau, Real Capital Analytics, Siblis Research, and SIFMA Research, as of April 2024.

-

Sources: Invesco Real Estate using real estate data from NCREIF (NPI) and Bloomberg (S&P 500 Index for US equity; Bloomberg US Aggregate Bond Index for US bonds). Income return reflects the annual average from Jan. 1, 2004 to Dec. 31, 2023. You cannot invest directly in an index. Past performance is not indicative of future results. There is no guarantee that any trends shown herein will continue.

-

This does not constitute tax advice. Because each investor’s tax position is different, the benefits listed above may not be realized. A change in US tax laws could also have impact on the benefits of investing in real estate. Taxes can be reduced due to the 20% deduction permitted on REIT distributions through 2026, deferred due to reduction in cost basis due to ROC, and eliminated due to step-up in basis upon death. At this time, the 20% rate deduction to individual tax rates on the ordinary income portion of distributions is set to expire on December 31, 2025. Invesco does not provide tax advice. Investors should always consult with a tax professional before making any investment decisions.

-

Ordinary income is any payment or income, earned by an individual or organization at marginal tax rates; for an individual, this is usually pretax salaries and wages an individual has earned. Capital gain refers to the increase in the value of a capital asset when it is sold; for an individual, this is usually the profit from the sale of property or an investment. Return of capital (ROC) is a payment, or return, received from an investment that is not considered a taxable event and is not taxed as income.

-

A step-up in basis is the readjustment of the value of an appreciated asset for tax purposes upon inheritance. The asset receives a step-up in basis so that the beneficiary’s capital gains tax is minimized. A step-up basis is applied to the cost.

Important information

NA3573675

Where individuals or the business have expressed opinions, they are based on current market conditions, they may differ from those of other investment professionals and are subject to change without notice.

US private real estate is represented by the NCREIF Property Index on the basis that the NPI is the broadest measure of private real estate index returns. The NPI is published by the National Council of Real Estate Investment Fiduciaries and is a quarterly, composite total return (based on appraisal values) for private commercial real estate properties held for investment purposes including fund expenses but excluding leverage and management and advisory fees. All properties in the NPI have been acquired, at least in part, on behalf of tax-exempt institutional investors and held in a fiduciary environment. NCREIF data reflects the returns of a blended portfolio of institutional quality real estate and does not reflect the use of leverage or the impact of management and advisory fees.

US equities are represented by the S&P 500 Index, an unmanaged index of the 500 largest stocks, weighted by market capitalization and considered representative of the broader stock market. The S&P 500 Index is subject to market risk.

US bonds are represented by the Bloomberg US Aggregate Bond Index, an index of securities that covers the US investment grade fixed rate bond market, with index components for government and corporate securities, mortgage pass-through securities and asset-backed securities; and is subject to credit risk.

US Treasury or T-bills are represented by the Bloomberg 90 Day U.S. Treasury Bill Index, an unmanaged index designed to measure the performance of public obligations of the U.S. Treasury that have a remaining maturity of greater than or equal to 1 month and less than 3 months.

The S&P 500 Index, the Bloomberg US Aggregate Bond Index and the Bloomberg 90 Day U.S. Treasury Bill Index are meant to illustrate general market performance; it is not possible to invest directly in an index.

The indexes noted above represent investments with material differences from an investment in private real estate, including related vehicle structure, investment objectives and restrictions, risks, fluctuation of principal, safety, guarantees or insurance, fees and expenses, liquidity, and tax treatment. An investment in private real estate may not be a direct investment in real estate and has material differences from a direct investment in real estate, including those related to fees and expenses, liquidity, and tax treatment.

Investment risks

The value of investments and any income will fluctuate (this may partly be the result of exchange rate fluctuations) and investors may not get back the full amount invested. Property and land can be difficult to sell, so investors may not be able to sell such investments when they want to. The value of property is generally a matter of an independent valuer’s opinion and may not be realized.

Fixed-income investments are subject to credit risk of the issuer and the effects of changing interest rates. Interest rate risk refers to the risk that bond prices generally fall as interest rates rise and vice versa. An issuer may be unable to meet interest and/or principal payments, thereby causing its instruments to decrease in value and lowering the issuer’s credit rating.

Treasury securities are backed by the full faith and credit of the US government as to the timely payment of principal and interest.

Generally, real estate assets are illiquid in nature. Although certain kinds of investments are expected to generate current income, the return of capital and the realization of gains, if any, from an investment will often occur upon the partial or complete disposition of such investment.

Investing in real estate typically involves a moderate to high degree of risk. The possibility of partial or total loss of capital will exist.

Why invest in US private real estate? by Invesco US